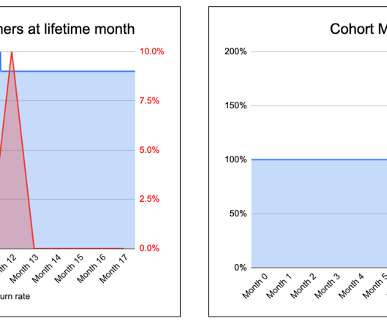

8 Out of 10 SaaS Founders Are Burning Cash Faster Than Ever — And Why YC is On Fire (SVB’s 2025 Data Breakdown)

SaaStr

MAY 27, 2025

Lemkin (@jasonlk) May 27, 2025 10 Unexpected Learnings from SVB’s 2025 State of the Markets Report Beyond the AI boom headlines, the 1H’25 data reveals surprising shifts that could reshape how we think about venture capital, startup operations, and the innovation economy.

Let's personalize your content