3 Ways I’ve Changed Venture Investing at SaaStr Fund

SaaStr

MAY 25, 2025

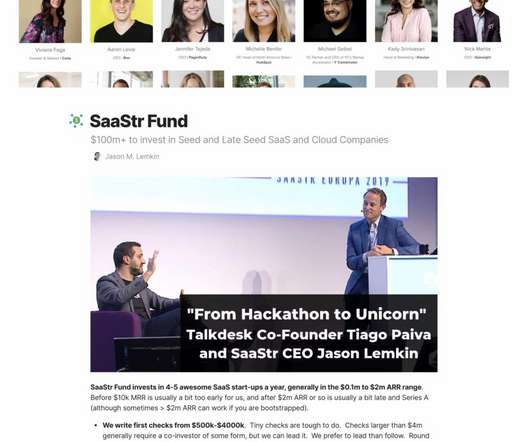

So I’m mostly made good investing decisions. My first VC investments were Pipedrive ($1.5B So if interested — here are the changed I’ve made to investing at SaaStr Fund : #1. Don’t Invest Without an S-Tier CTO If you follow me on social media, this won’t be a surprise, as I say it all the time.

Let's personalize your content