5 Things To Be Wary of In VC Financings

SaaStr

FEBRUARY 2, 2021

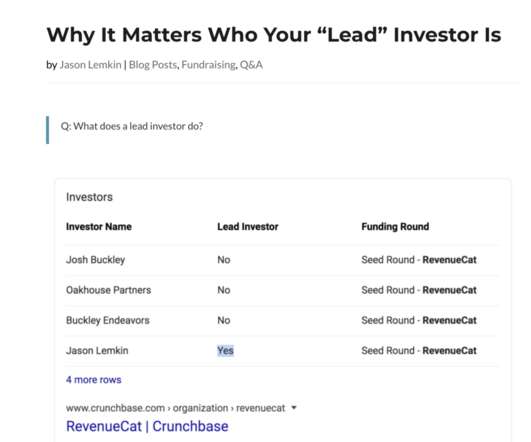

Even these days, in The Best of Times for SaaS, many founders are wary of Venture Capital. But early-stage venture capital is so risky. The post 5 Things To Be Wary of In VC Financings appeared first on SaaStr. Aren’t they just trying to buy shares too cheaply? Well, yes, sometimes. And be honest.

Let's personalize your content