Raising Venture Capital in 2024? The Air is Very, Very Thin Above $200,000,000 Valuations

SaaStr

DECEMBER 29, 2023

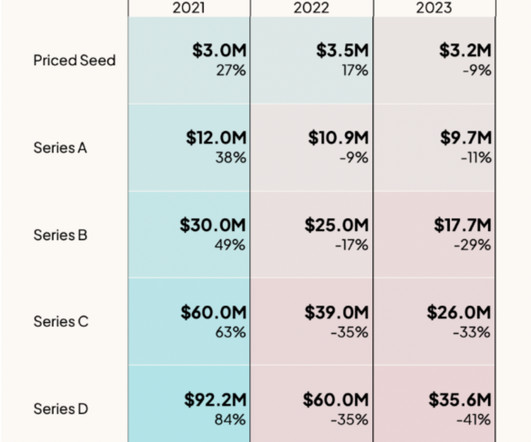

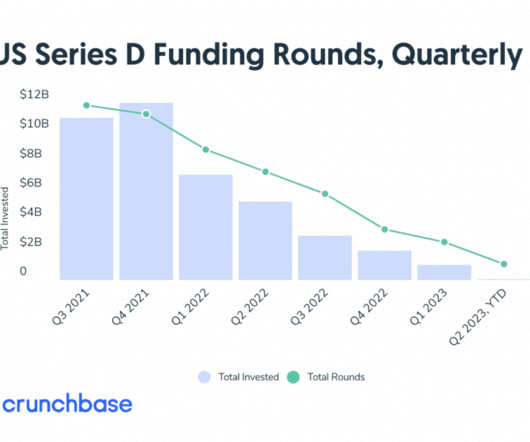

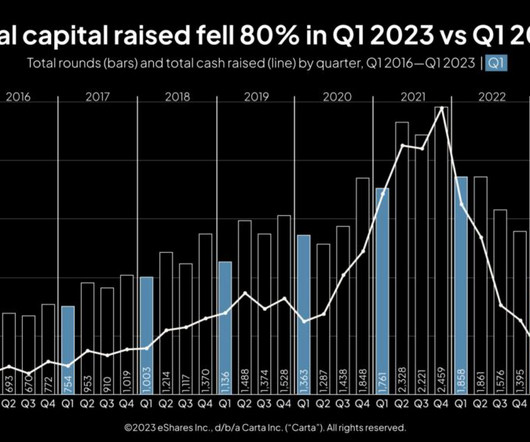

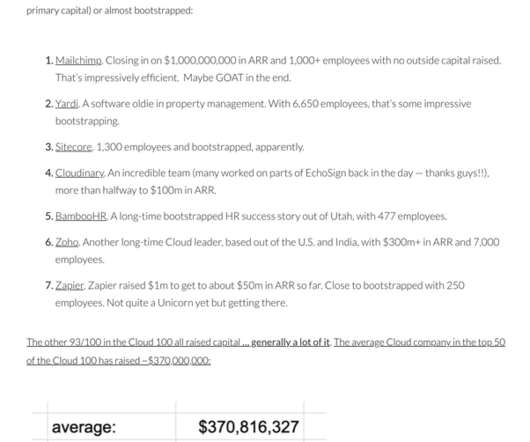

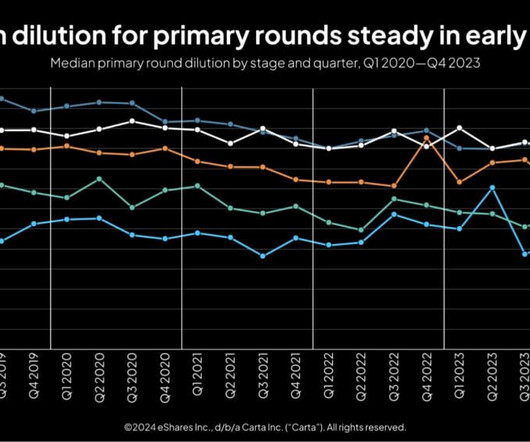

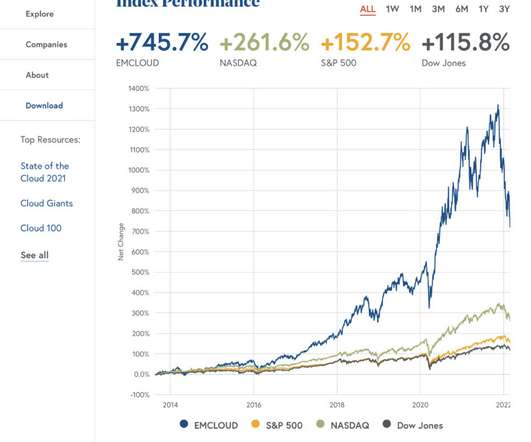

If I had to summarize venture capital today, it would be like this: There is Very Little Oxygen Today Above $200m Valuations What do I mean? It’s still a weird world in venture: Firms are both shutting down and raising new funds. It becomes mathematically very hard to make 8x-10x on any valuation in SaaS above $200m post-money.

Let's personalize your content