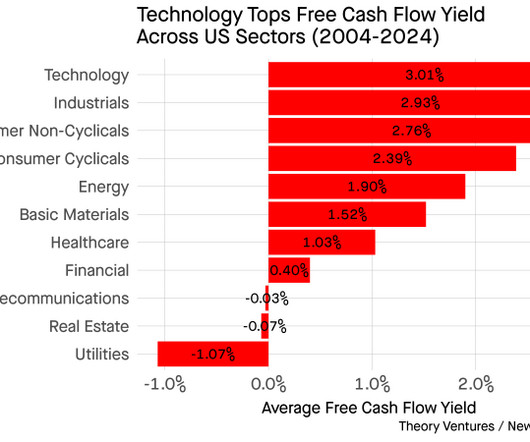

Are Software Companies Good Businesses?

Tom Tunguz

APRIL 21, 2024

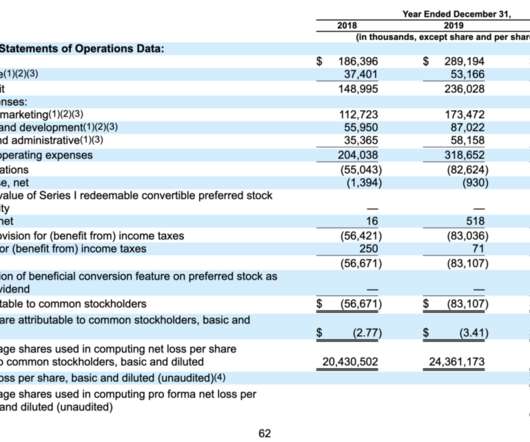

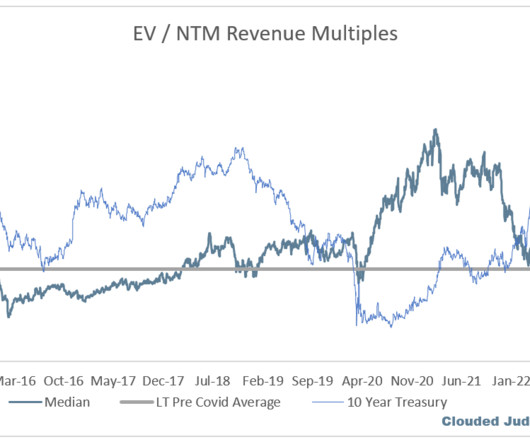

Different accounting rules govern revenue & cost recognition. 1 FCFY is a metric that measures this : how much of a company’s revenue, after funneling through every cost imaginable, is left over in its bank account at the end of the year. Quite a stark difference. That’s my mental model for it, anyway.

Let's personalize your content