Dear SaaStr: When is a Startup Ready to Raise Venture Capital These Days?

SaaStr

MAY 27, 2023

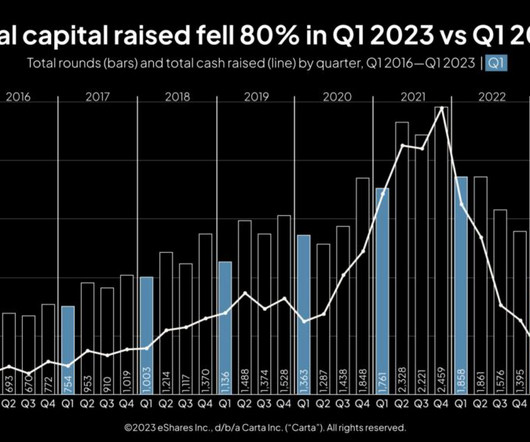

Dear SaaStr: When is a Startup Ready to Raise Venture Capital These Days? Churn too high Burn too high Competitors growing faster Already raised “too much” capital The post Dear SaaStr: When is a Startup Ready to Raise Venture Capital These Days? A lot harder. Doesn’t really matter why.

Let's personalize your content