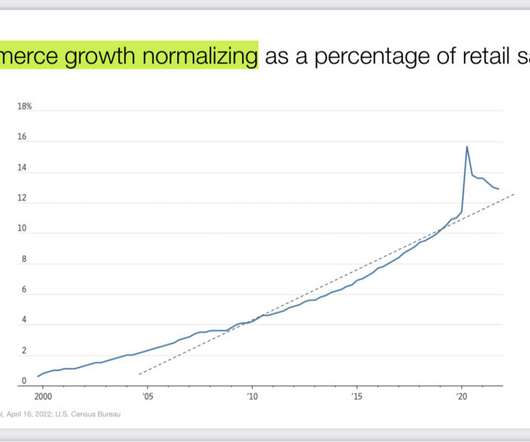

In The End, The “Covid Boost” in SaaS Was a Bust

SaaStr

JUNE 21, 2022

Almost every category of SaaS exploded during the lockdown, but three saw just crazy boosts: Zoom went from $1B to $3.5B We’d never seen revenue acceleration like this ever in B2B software. We’d never seen revenue acceleration like this ever in B2B software. Other categories were hit less dramatically. It couldn’t last.

Let's personalize your content