Do You Really Need Venture Capital To Build A Top SaaS Company?

SaaStr

MAY 26, 2020

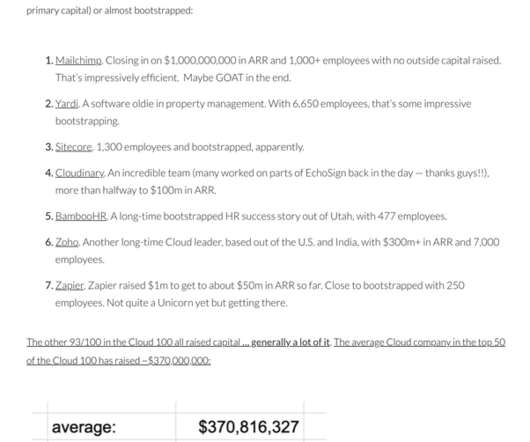

Q: How many companies in the Fortune 500 raised venture capital? Why are so many people obsessed with venture capital when many successful businesses didn’t raise it? There are many successful companies that did not raise venture capital, and VC does seem to get a bit too much media attention.

Let's personalize your content