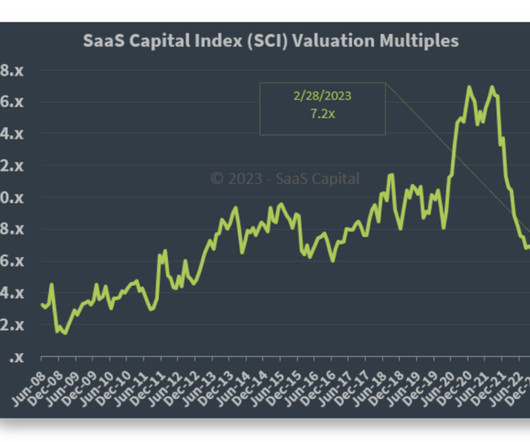

The Three Valuation Lows in SaaS: 2013, 2016, and 2022

SaaStr

MARCH 10, 2023

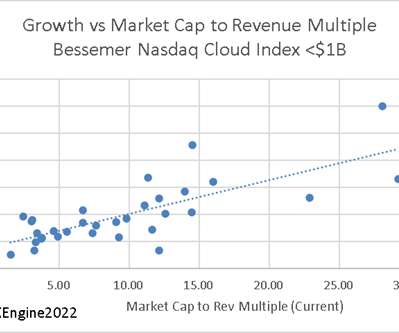

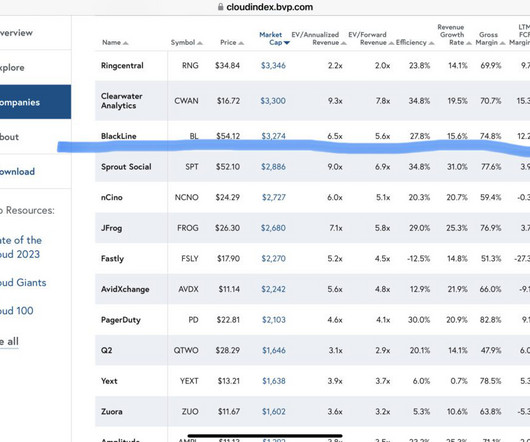

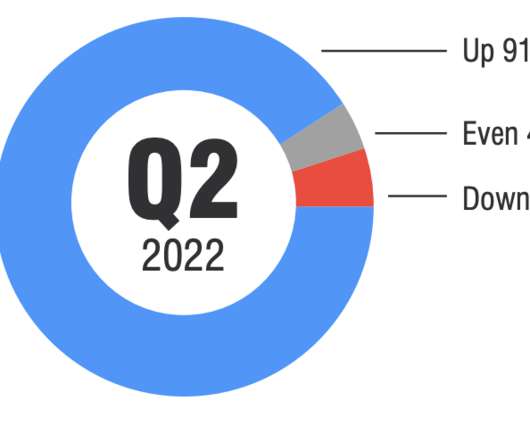

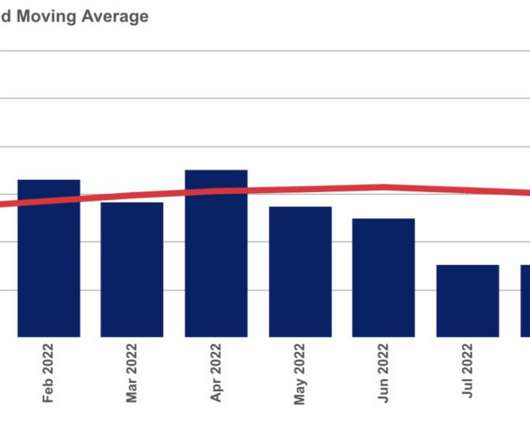

The SaaS Capital Index from SaaS Capital had a nice summary this week of the 3 low points we’ve seen in SaaS multiples, and this chart puts things in great context: As you can see above, in the early days of SaaS … it was tough to be a public SaaS company. It was just too hard to make money at 4x ARR.

Let's personalize your content