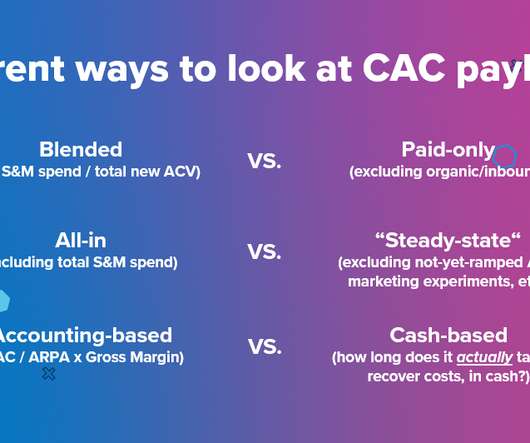

CAC Payback Period – To Include Gross Margin or Not?

OPEXEngine

JUNE 23, 2021

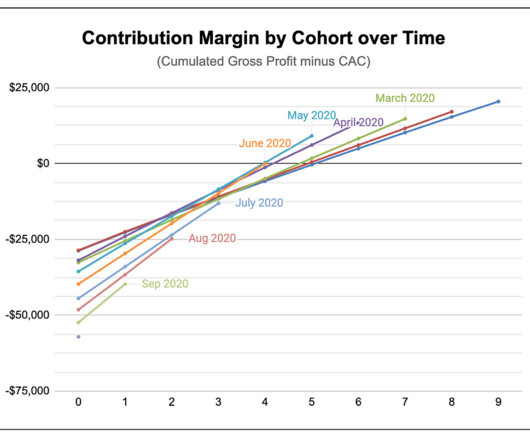

The CAC Payback Period, also known as Months to Recover Customer Acquisition Cost (CAC), measures the number of months of subscription revenue it takes to recover the costs to acquire one customer. The basic way to calculate this metric is to divide CAC by Average Revenue per Customer Account or ARPA.

Let's personalize your content