A Look Back at Q1 '25 Public Cloud Software Earnings

Clouded Judgement

JUNE 17, 2025

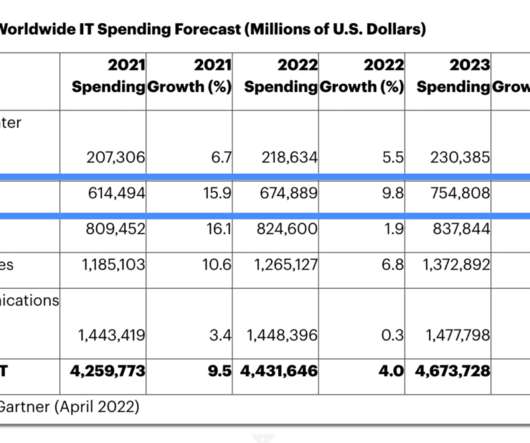

And no, this wasn’t all because of leap year last year (that would only account for a ~3% delta at most) The Hyperscalers (AWS, Azure, Google Cloud) also declined net new adds year over year, but not by as much. The overall software universe quarterly YoY growth has come down meaningfully from highs, but has started to stabilize.

Let's personalize your content