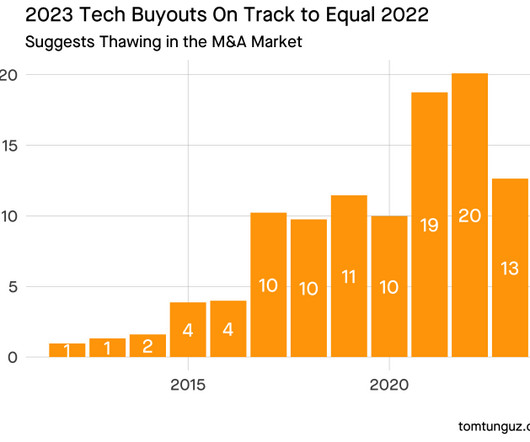

Do PE Acquisitions of Public Startups Imply We've Hit a Pricing Bottom?

Tom Tunguz

AUGUST 7, 2022

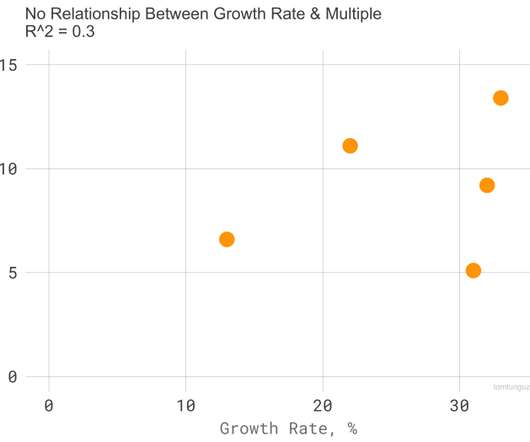

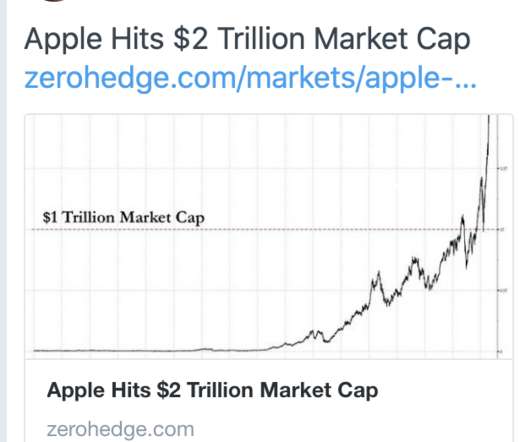

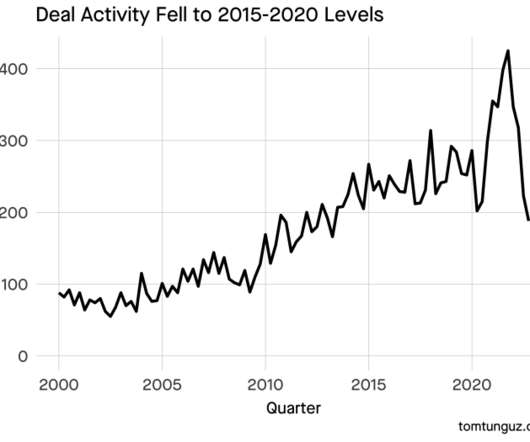

But no relationship exists between the Nasdaq’s price level & multiples. Zendesk & Anaplan announced their acquisitions within days of each other & their multiples bound the outer edges of the range: 5.1x & 13.4x. The more free cash the company produces, the lower the acquisition multiple. Growth Rate.

Let's personalize your content