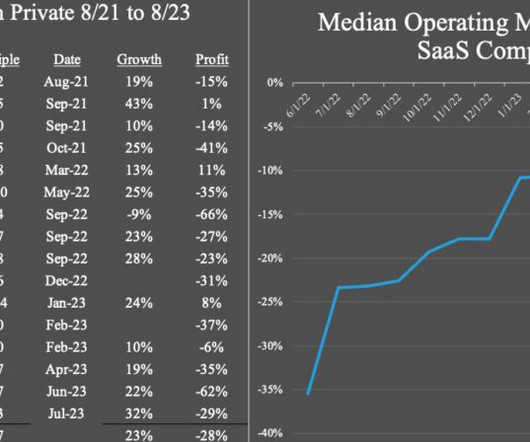

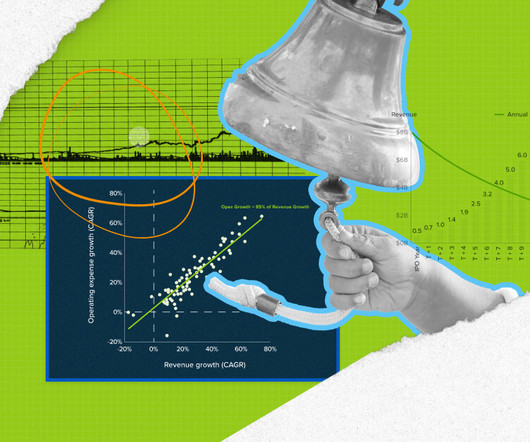

What Are Public SaaS Companies Taken Private At? 7.7x ARR On Average Per SaaSomomics

SaaStr

NOVEMBER 17, 2023

The prices would be lower today for the latter two I suspect. ARR was the Median acquisition price in a “take private deal” Interestingly, it’s not all that different post-Boom and pre-Boom, as you can see above. What did he find? You might be worth less ? is interesting to see.

Let's personalize your content