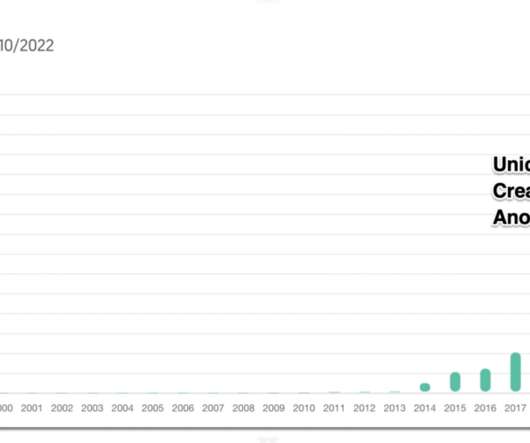

The 2014 Class of SaaS IPOs

Tom Tunguz

DECEMBER 3, 2014

2014 has been a great year for SaaS companies. A few interesting trends emerge from the data: First, the two last IPOs, New Relic and Hortonworks both have priced their IPO at below their last round price. Third, the average SaaS IPO in 2014 raised 4 rounds of capital. By my count, 9 of them will have gone public.

Let's personalize your content