Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital?

SaaStr

JULY 5, 2023

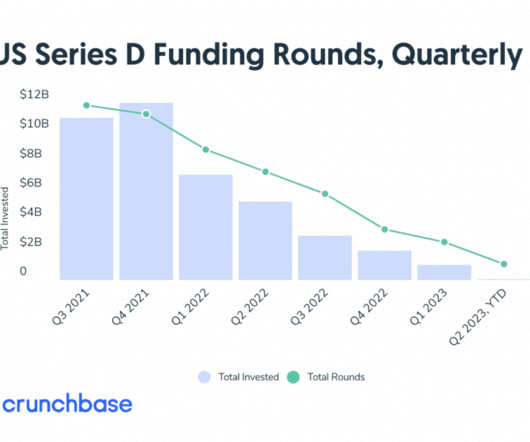

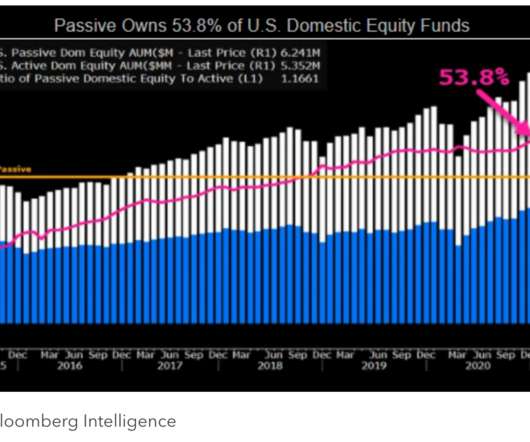

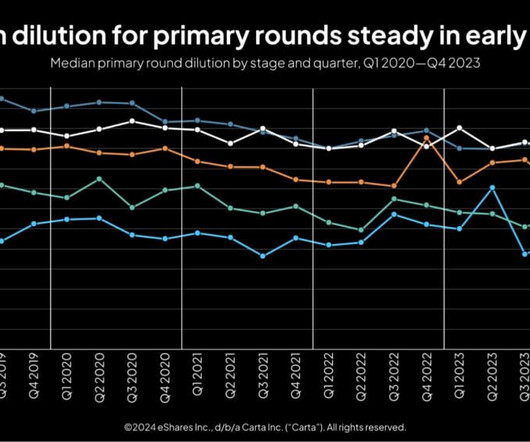

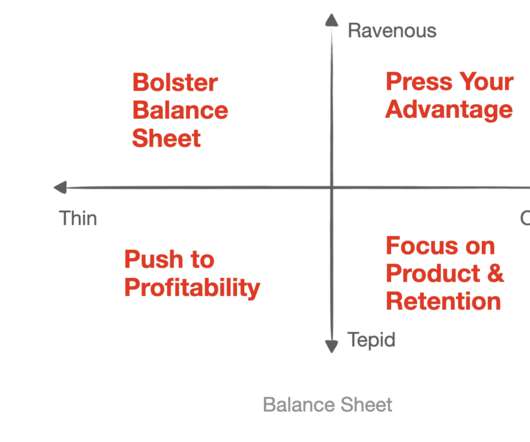

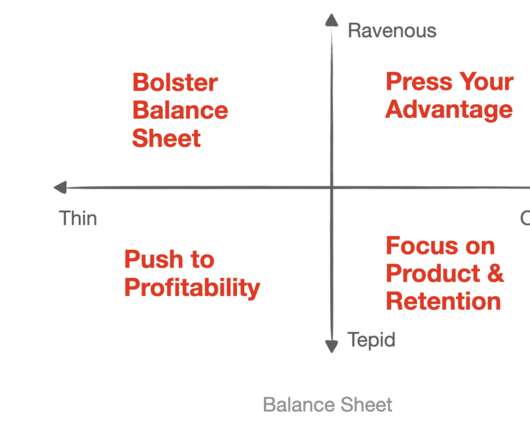

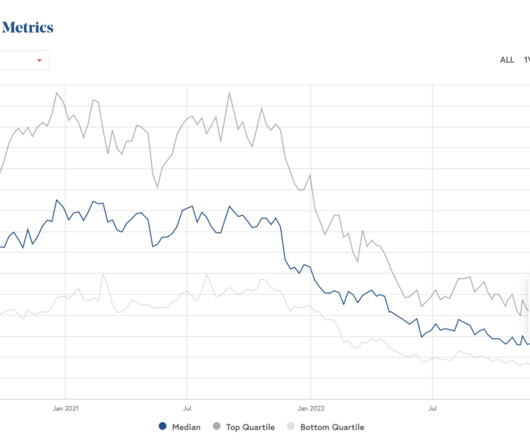

Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital? A deep dive on why late stage is harder than you might think here: The post Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital? appeared first on SaaStr.

Let's personalize your content