How Venture Capital Has Changed Since Covid-19

SaaStr

AUGUST 16, 2020

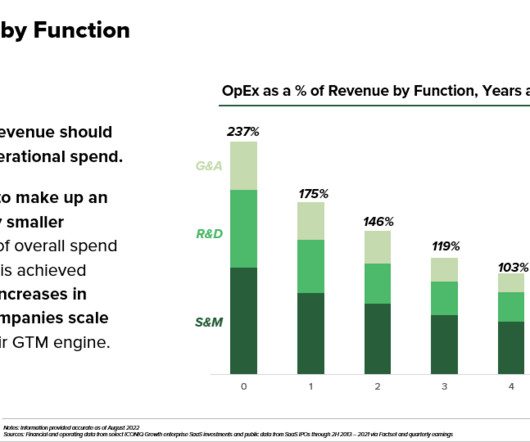

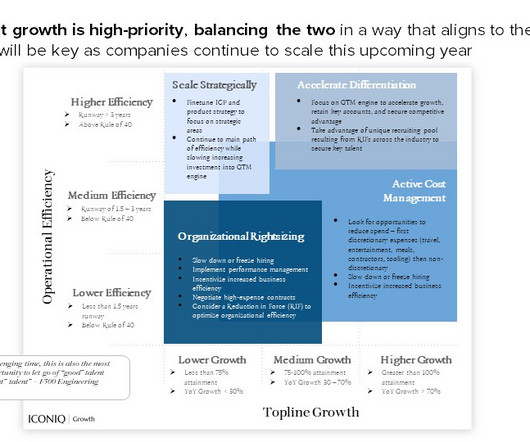

Q: How is Venture Capital difference since Covid-19? As did Cloud revenues. The ones with good, but not great, metrics. SaaStr New New Venture 2020. The post How Venture Capital Has Changed Since Covid-19 appeared first on SaaStr. At first — and only briefly — things slowed way back. That was easy.

Let's personalize your content