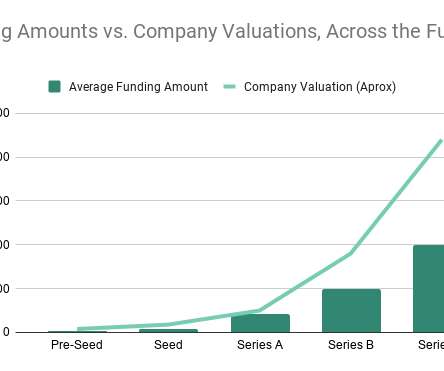

The growing dissonance between two business models (SaaS and VC)

The Angel VC

MAY 17, 2017

In our weekly investment team call earlier this week we decided to pass on two early-stage SaaS startups that were both on track to grow from zero to $100k in MRR in their first 12 months of going live. And chances are that it would have been a good investment. As Clément said, this is not about good or bad.

Let's personalize your content