Dear SaaStr: How Do You Evaluate Startups for Seed Investments?

SaaStr

DECEMBER 31, 2024

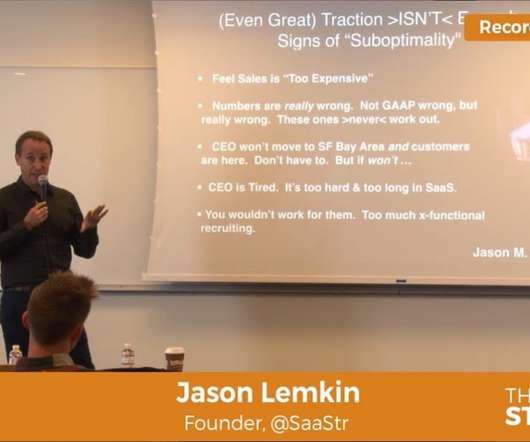

Dear SaaStr: How Do You Evaluate Startups for Seed Investments? Here are our criteria for SaaStrFund.com : Are both the CEO and CTO insanely good? Its a high bar, but if the founders dont meet it, Ive found there is a 0% chance of making enough money for a venture investment to work out. Better than I was as a founder?

Let's personalize your content