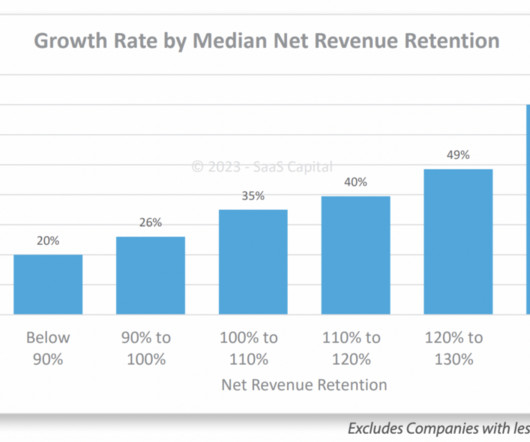

SaaS Capital Survey of 1,500 SaaS Companies: High NRR Startups Grow Twice as Fast

SaaStr

SEPTEMBER 2, 2023

Figure 5 comes from our 2023 SaaS Retention Benchmarks for Private B2B Companies and highlights the relationship between growth and retention. This relationship is a rare example of increasing returns from investment in upsells and cross-sells. This is a rare example of increasing returns from investment in upsells and cross-sells.

Let's personalize your content