When a VC Investment Fails, Does That Mean It Was a Bad Investment? Probably Not

SaaStr

MARCH 31, 2020

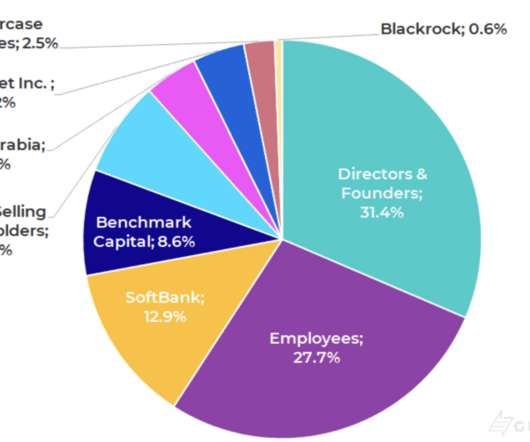

With venture capital investments that fail, is the problem most often with the entrepreneur or was it a bad investment by the VC? The earlier stage you invest, the more often some of them just … don’t work out. Bill Gurley’s answer to How much money did Benchmark capital lose on Webvan? There often is no problem.

Let's personalize your content