Four key insights for SaaS and CS leaders from the 2024 B2B SaaS Benchmarking Survey

ChurnZero

MAY 2, 2024

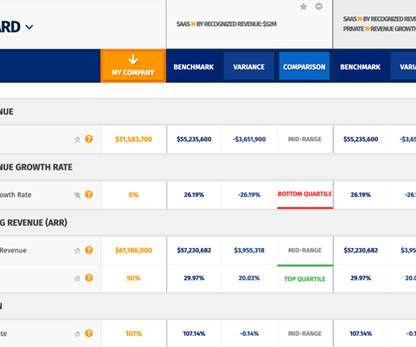

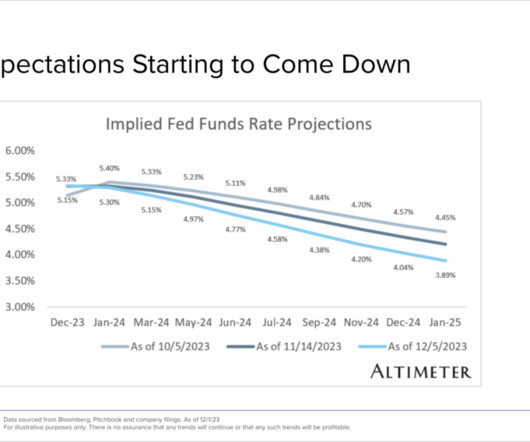

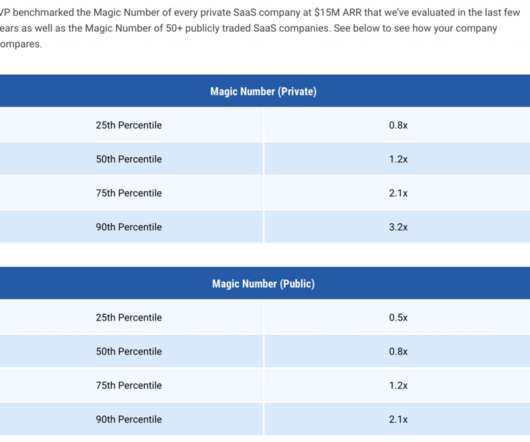

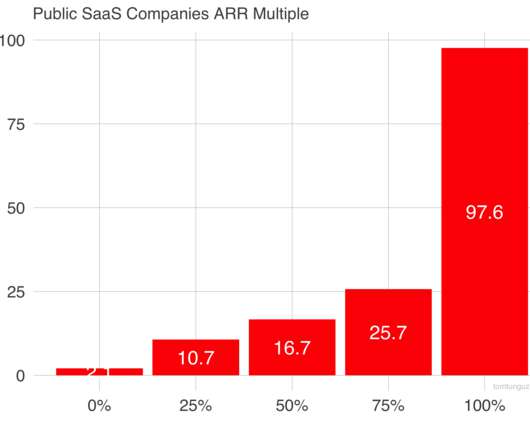

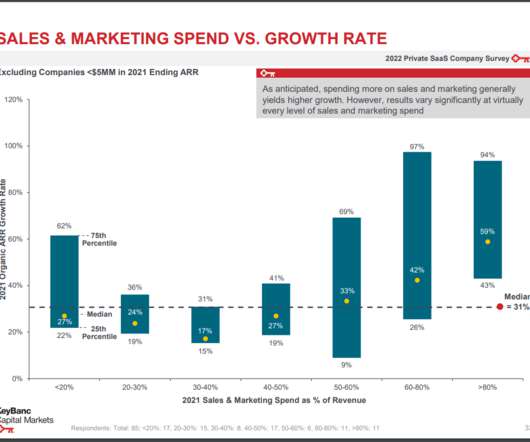

The 2024 B2B SaaS Benchmarking Survey by SaaS Capital is the most comprehensive and up-to-date source of its kind for SaaS and customer success leaders who want to know where they stand compared to peers and competitors. Takeaway 1: Equity is hard to get right now, and very few people are doing it.

Let's personalize your content