The Future of B2B SaaS Investing with G2, Accel, Salesforce, Inspired Capital and SaaStr

SaaStr

DECEMBER 25, 2023

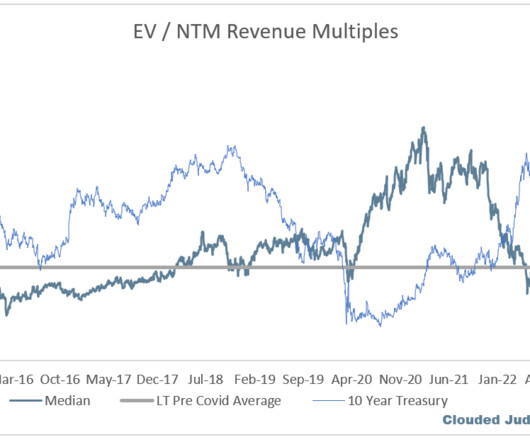

G2 had us back for another great deep dive on just where SaaS investing is there days, and it was a great panel: Accel Partner Arun Mathew Inspired Capital Founder & Managing Partner Alexa von Tobel Salesforce Ventures Managing Partner Paul Drews and Jason Lemkin! Low investment multiples pose a key challenge.

Let's personalize your content