High NRR Can Scale Infinitely. Invest More There.

SaaStr

AUGUST 25, 2021

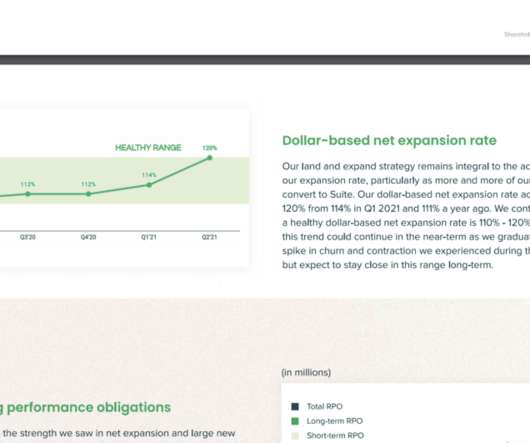

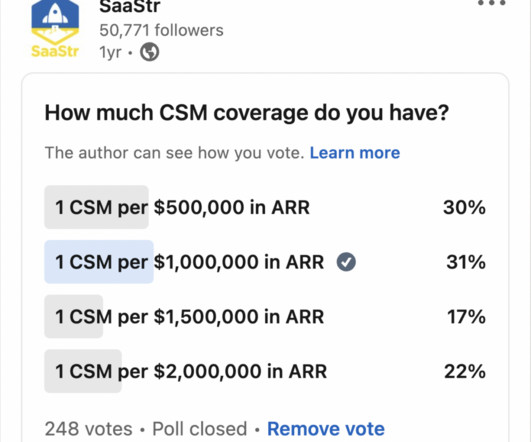

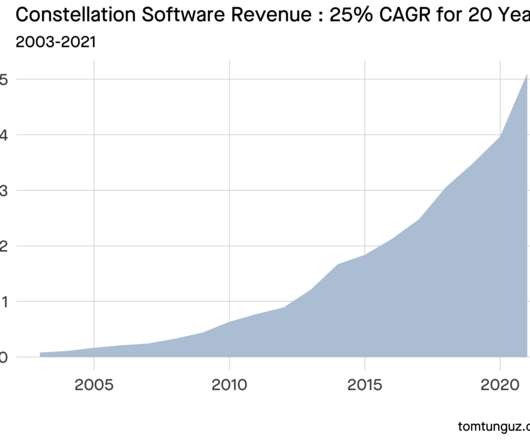

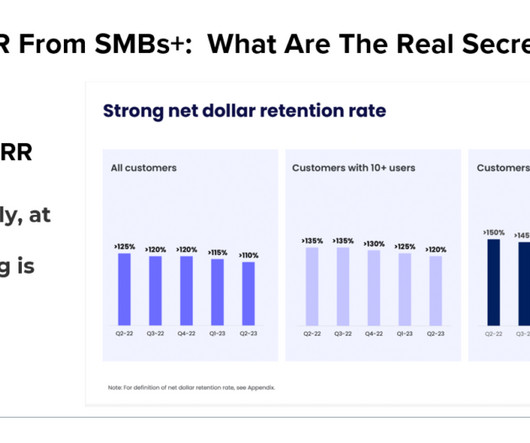

But the vast majority of the top SaaS and Cloud companies have shown top-tier NRR can scale forever. The post High NRR Can Scale Infinitely. Invest More There. Bill.com sells to SMBs and it also saw its NRR expand post-IPO. Zendesk’s NRR here: There will be exceptions, of course. Probably even to $10B+ in ARR.

Let's personalize your content