Mean Reversion: When Will Startup Investing Return to Normal?

Tom Tunguz

AUGUST 20, 2023

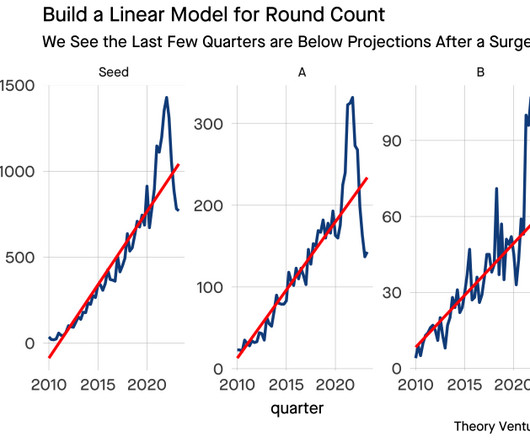

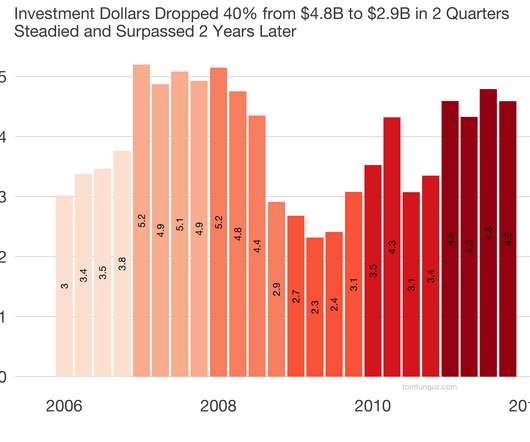

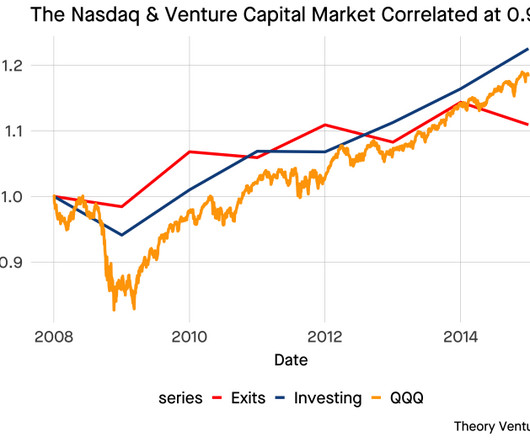

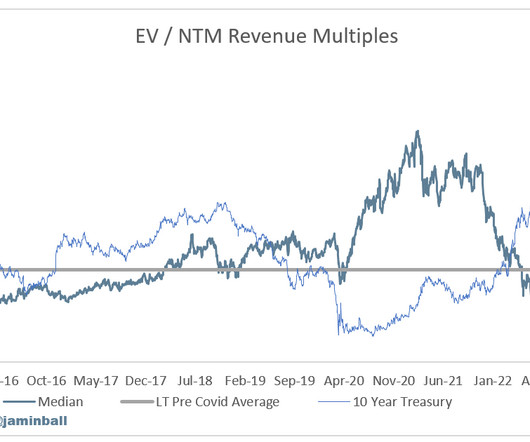

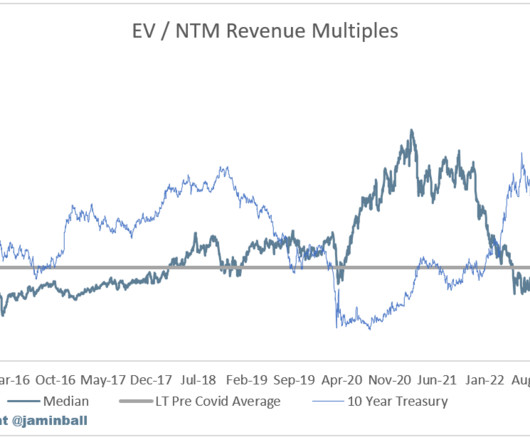

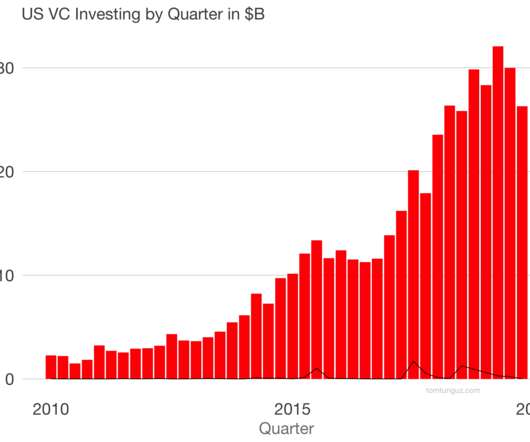

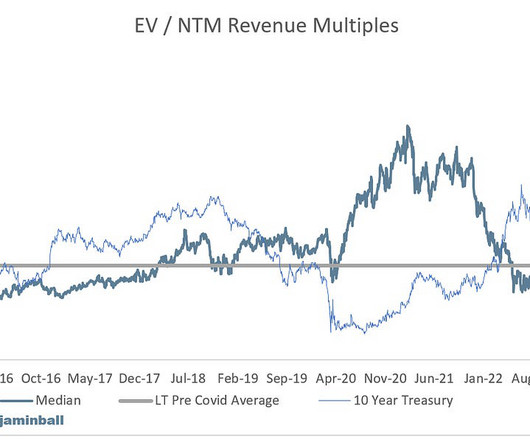

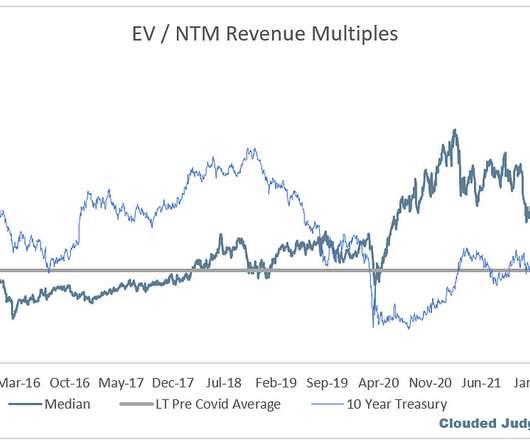

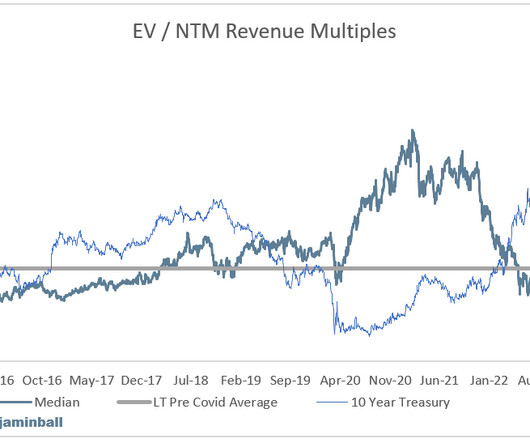

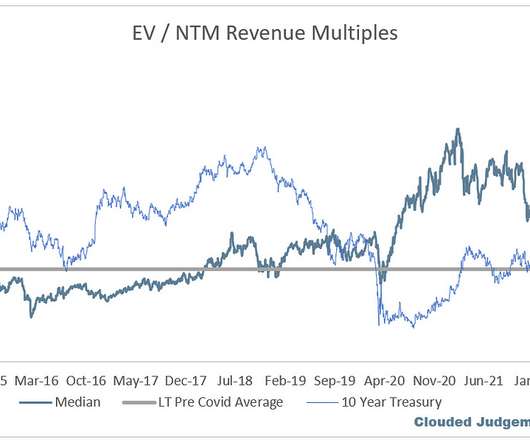

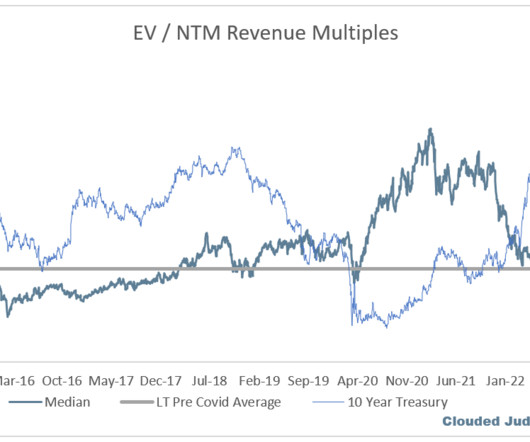

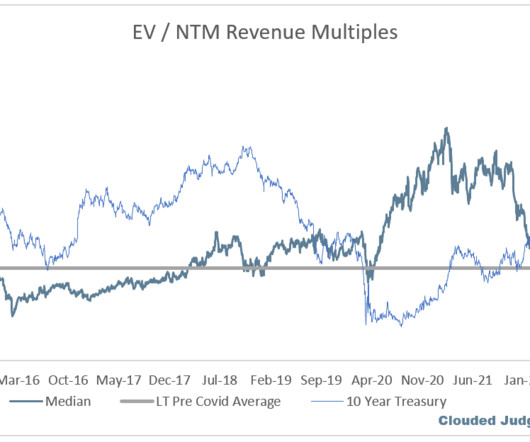

Since then, investing activity dropped precipitously. The red is a linear model based on data from 2010 to 2018 that predicts activity rates for each financing series of US & Canadian software companies. [1] When a collapse follows a surge, mean reversion suggests behavior should revert to a reasonable baseline.

Let's personalize your content