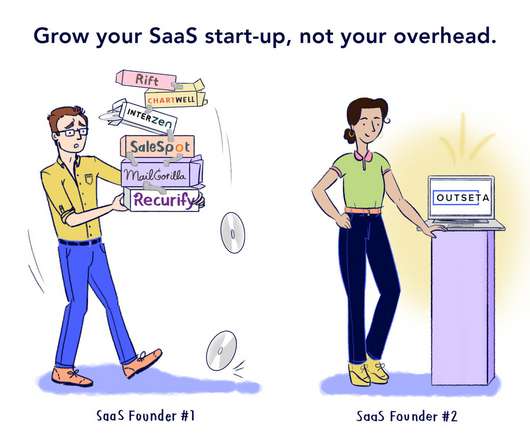

Thanks to Carta, Make, Outreach, SAP, and Worldline for Sponsoring SaaStr Europa 2023!

SaaStr

JUNE 1, 2023

We’ll see 2,500+ of the best SaaS founders, execs, and VCs NEXT WEEK June 6-7 at 2022 SaaStr Europa ! The company is trusted by more than 30,000 companies, over 5,000 investment funds, and half a million employees for cap table management, compensation management, liquidity venture capital solutions, and more.

Let's personalize your content