Why Now is a Great Time to Raise Seed Funding. Even If It’s Awful for Series A-E Rounds.

SaaStr

JANUARY 23, 2023

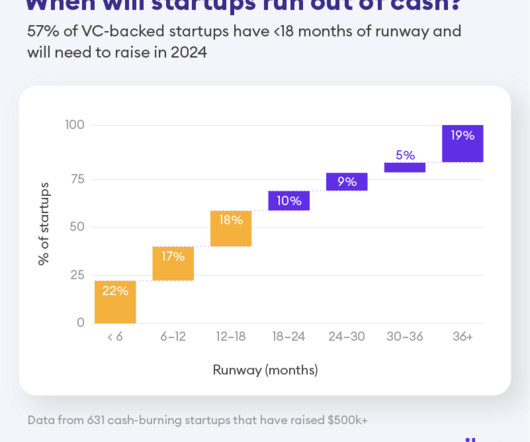

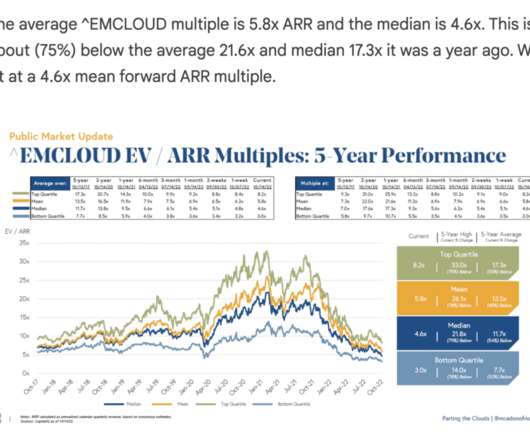

So now is simply a terrible time to be raising growth stage venture capital. A great deep dive on later-stage SaaS investing here: And look venture is a mess today. Even If It’s Awful for Series A-E Rounds. Crypto investments are going bankrupt. Board meetings are endless drama sessions.

Let's personalize your content