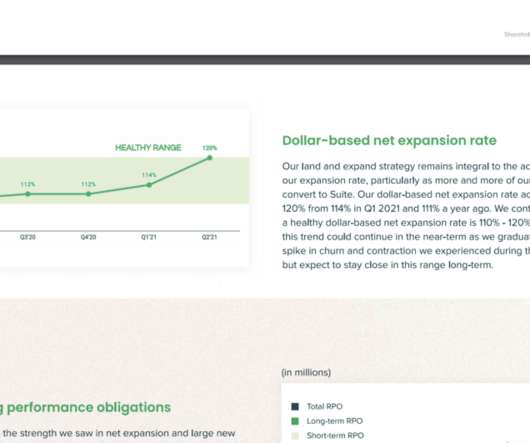

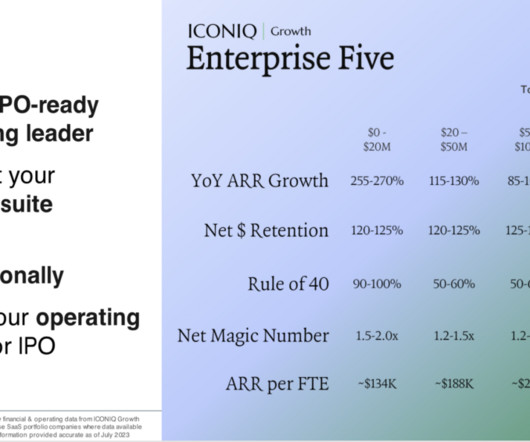

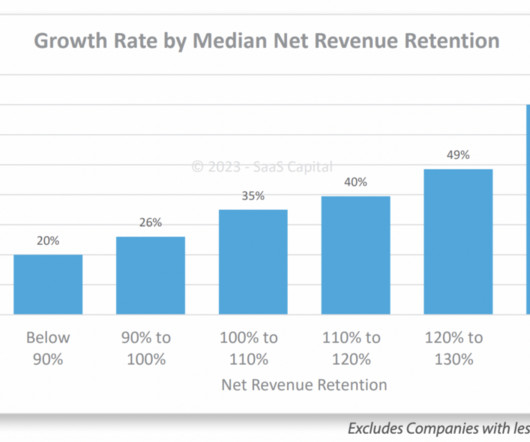

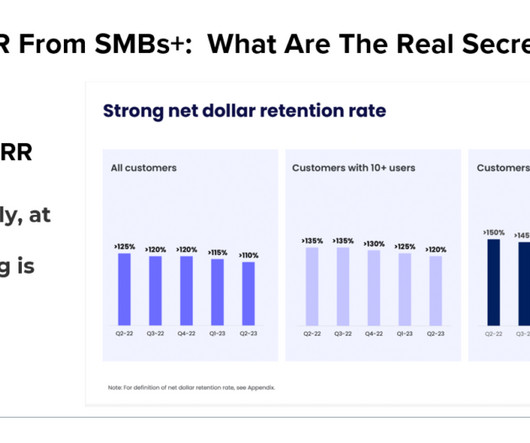

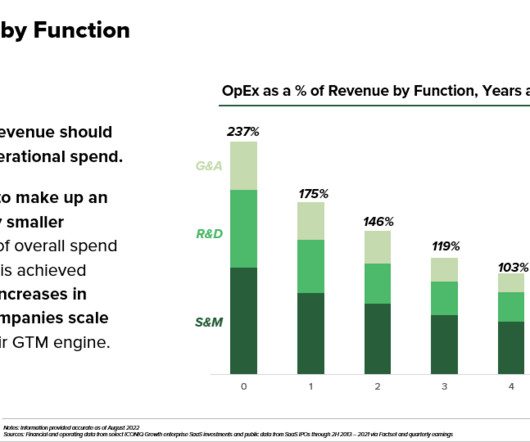

High NRR Can Scale Infinitely. Invest More There.

SaaStr

AUGUST 25, 2021

A question so many of us had in the earlier days of SaaS was … will we max out all our bigger customers? We all saw especially larger customers buying more and more each year, but most of us founders a generation or so ago in SaaS worried we’d max out our larger accounts. The post High NRR Can Scale Infinitely.

Let's personalize your content