Dear SaaStr: What Happens After You Raise Venture Capital for the First Time?

SaaStr

AUGUST 1, 2021

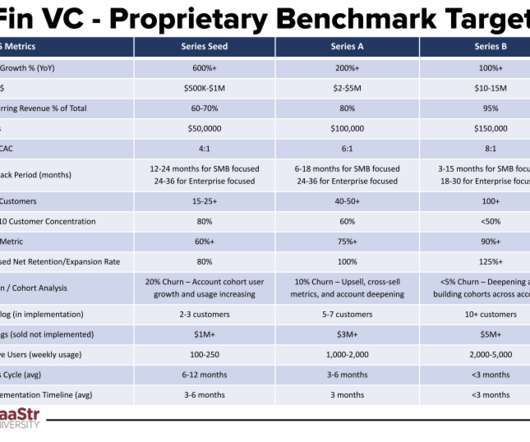

Q: Dear SaaStr: What Happens and Changes After You Raise Venture Capital for the First Time? A few thoughts if you haven’t raised venture capital before: 1. Be extremely transparent and data-driven. And get them detailed Board packs and metrics at least 3 days before each Board meeting.

Let's personalize your content