Why we invested in Athenian

Point Nine Land

MARCH 15, 2022

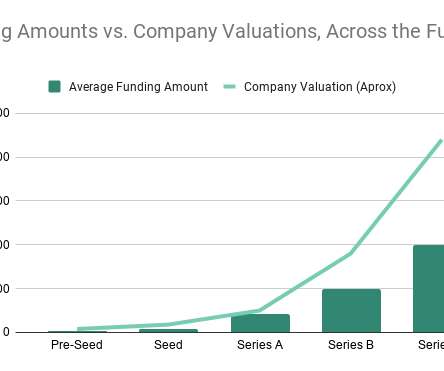

If you take a look at a 50 person sales team, you’ll likely find it to be very data-driven. They usually track low-level metrics about their app performance or errors, and agile teams have burn-down charts. But because the data lives in different systems (e.g. Providing a lot of data is comparably easy.

Let's personalize your content