Why The Era of Efficient Growth is Now: The 2023 VC State of the Market with SaaStr CEO and Founder Jason Lemkin (Podcast +Video)

SaaStr

JUNE 17, 2023

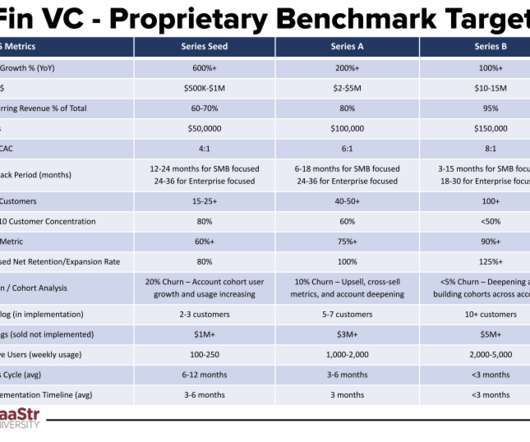

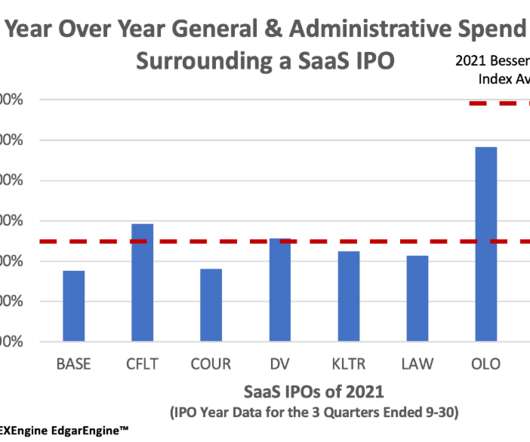

In the ever-evolving landscape of SaaS, Venture Capital, Bootstrapping, and Valuations – understanding market trends and investment patterns is critical. We’ll explain Jason’s take on the recent market fluctuations, highlighting major deals that shaped investment patterns and their effects on valuation trends.

Let's personalize your content