Why We Created a Slack Community for SaaS and Software Professionals

FastSpring

SEPTEMBER 16, 2022

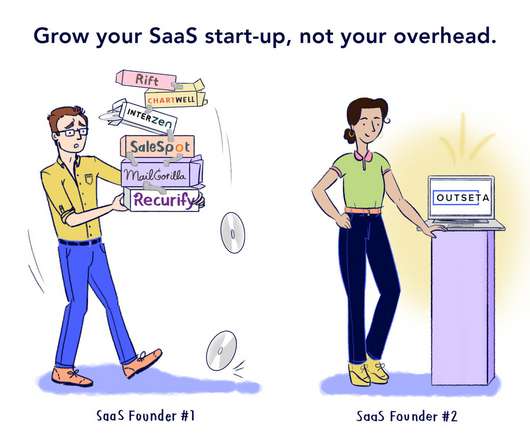

In our first post about our online community , we mentioned launching the Global SaaS Leaders Slack group because we saw a need for the kind of software-and-SaaS-focused community we’d want to be a part of. More established professionals and businesses (less students and early-stage startups). That includes: A global focus.

Let's personalize your content