Benchmarks for Employee Stock Based Compensation in SaaS Startups

Tom Tunguz

FEBRUARY 1, 2015

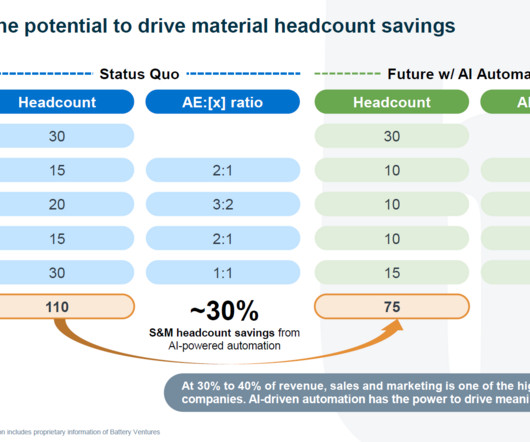

How much should your startup budget for its employee stock option pool? Another way is to look at the cash based cost of the stock based compensation. The chart above shows the average stock-based compensation (SBC) per employee by years since founding across the basket of publicly traded SaaS companies.

Let's personalize your content