What Brands Look for When Considering Acquiring Software Companies

FastSpring

DECEMBER 7, 2023

As the Director of Corporate Development & Strategic Partnerships at WP Engine , Carl has worked on many acquisitions and partnerships, including brands like Flywheel, Perfect Dashboard, Block Lab, and recently, Delicious Brains. Can you describe the process for buying and selling a business from a brand? Jump to highlights.

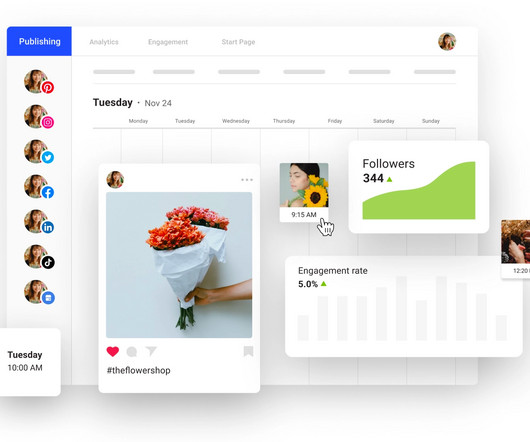

Let's personalize your content