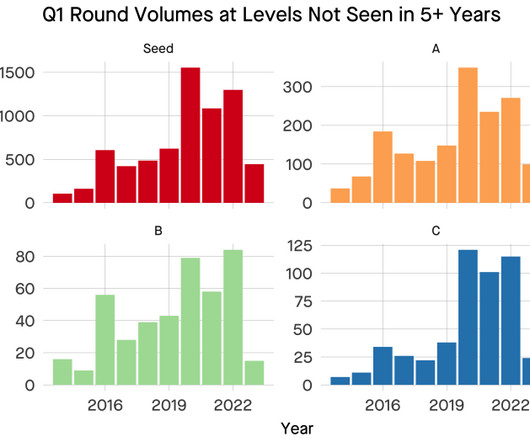

The Hardest Round to Raise in 2023

Tom Tunguz

MARCH 23, 2023

Q1 volumes by year show broad declines across early-stage venture capital. Examining the ratios of rounds, we can assess where capital is flowing. Second, startups who raised Series As in the last 18 months raised the biggest Series As seen since 2000. The hardest round to raise so far in 2023 is the Series B.

Let's personalize your content