Frequently Asked Questions: Integrated Payments for Software Companies

USIO

MAY 16, 2024

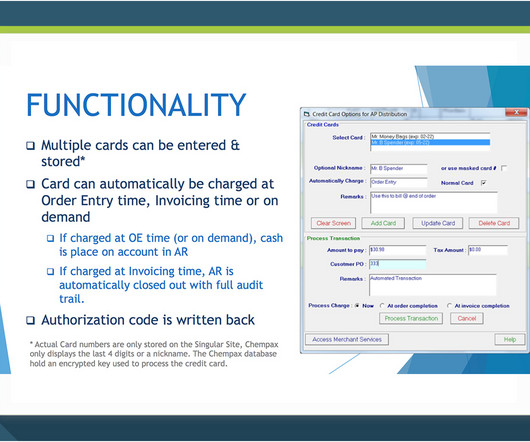

Integrated payments refer to the seamless incorporation of payment processing capabilities directly within a software application. This means users can make and receive payments without leaving the platform, providing a smoother and more efficient user experience. Compliance with local and international regulations is critical.

Let's personalize your content