What is Equity Financing?

Baremetrics

SEPTEMBER 24, 2021

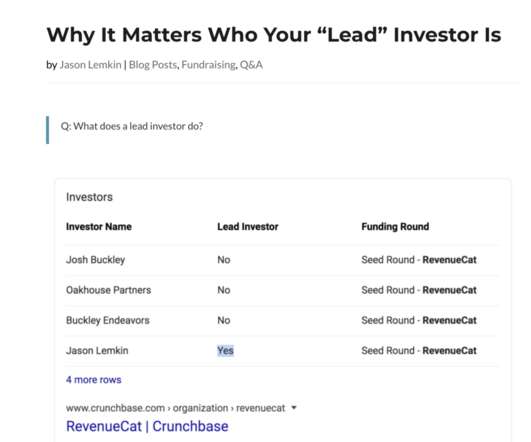

Equity financing is a method of capital raising via the selling of stock. Businesses grow money for a variety of reasons. They may need cash to meet immediate financial obligations or have a longer-term objective and require capital to invest in their development. What is Equity Financing in SaaS?

Let's personalize your content