What the $6B Coupa Acquisition Means for Software Startups

Tom Tunguz

DECEMBER 11, 2022

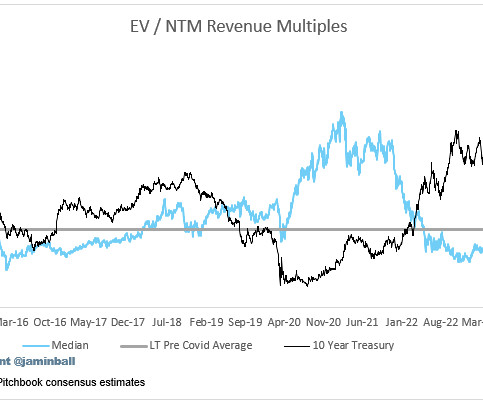

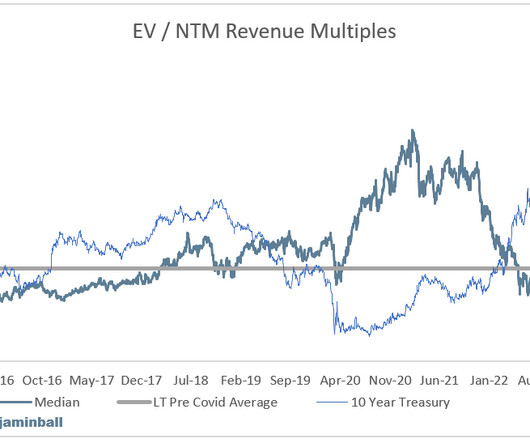

The acquisition is notable for three reasons. First, the premium to the public price is 31%. Third, it’s the most substantive acquisition to announce this year after Figma’s announced its sale to Adobe. As Michael Mauboussin writes in Expectations Investing , there’s information in price.

Let's personalize your content