Lowering the Hiring (And Investing) Bar Didn’t Work

SaaStr

APRIL 1, 2023

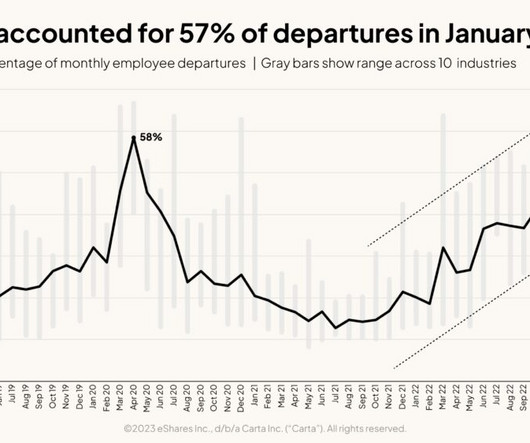

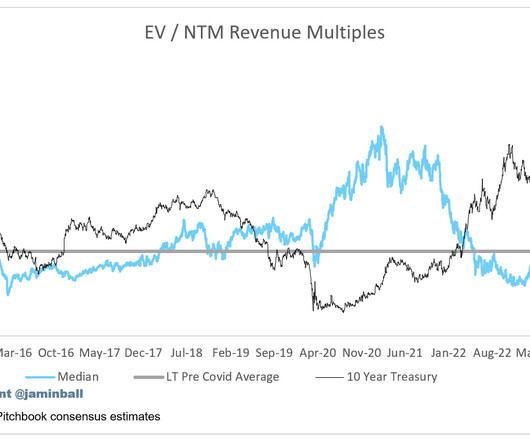

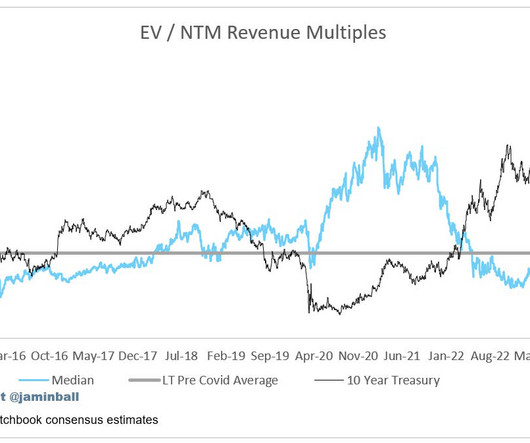

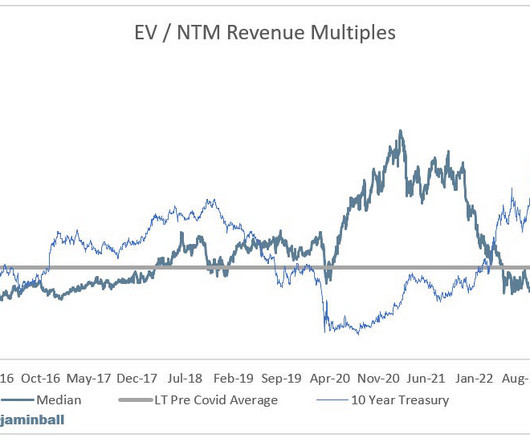

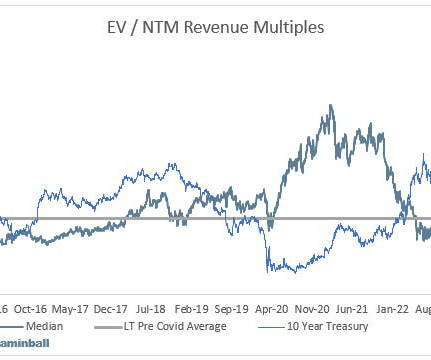

So everyone is now paying the price for lowering the bar in the Boom Times of mid ‘20 to early ‘22. And now we’re paying the price. The same things happened in VC and investing. I did some of this myself, both on people and investments. Better to do with fewer people, fewer investments, fewer initiatives.

Let's personalize your content