Why 2024 May Be Tougher on Venture Capital Than 2023

SaaStr

JANUARY 25, 2024

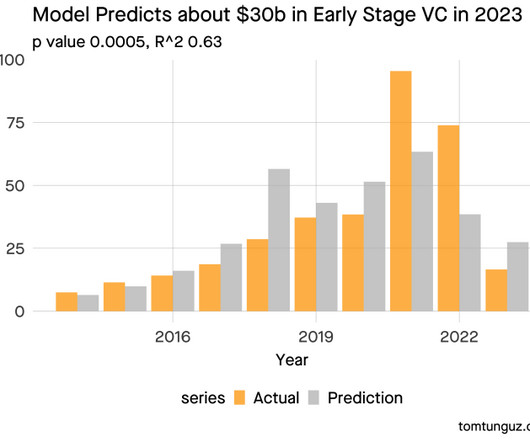

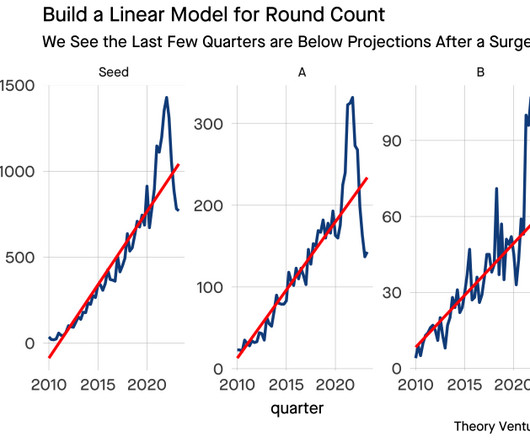

jasonlk) January 23, 2024 So I thought the toughest times for venture would be behind us now. And 2023 was the year of the Work Out in venture. It got real in 2023, and that realness got normalized. And public SaaS stocks in many cases did really, really well in 2023. That will weigh across venture.

Let's personalize your content