Clouded Judgement 2.29.24 - Shades of 2021

Clouded Judgement

MARCH 1, 2024

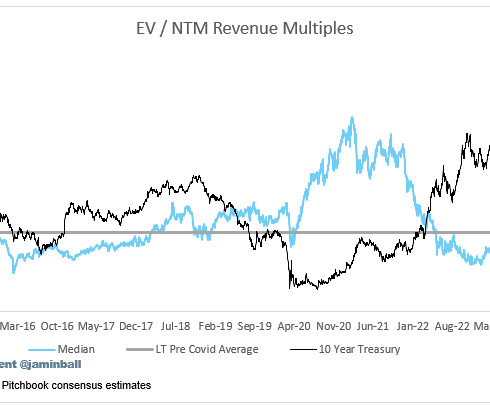

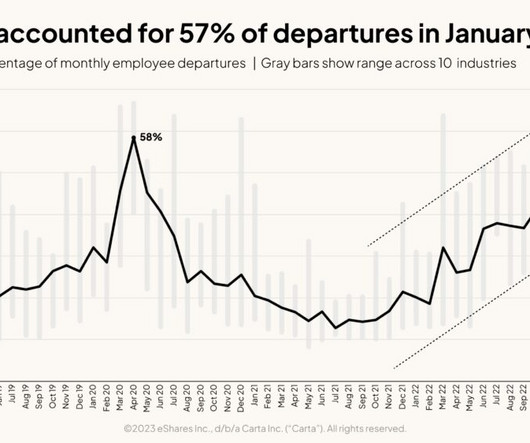

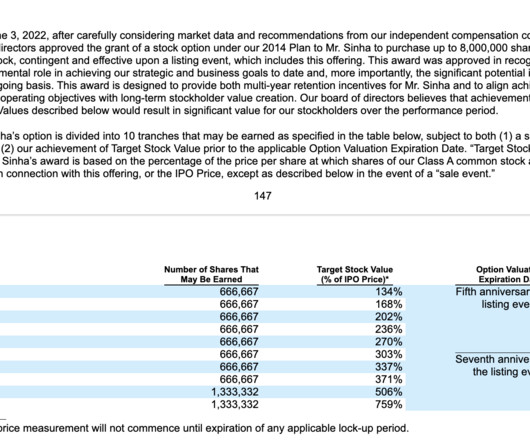

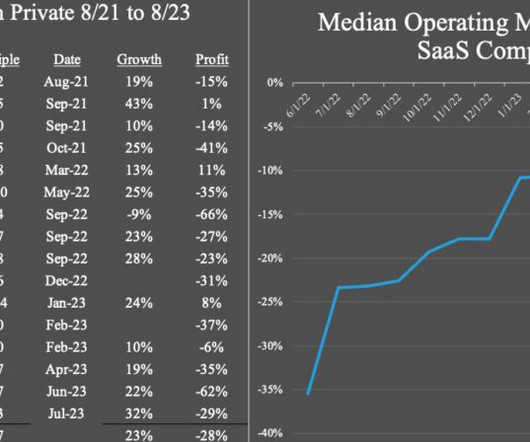

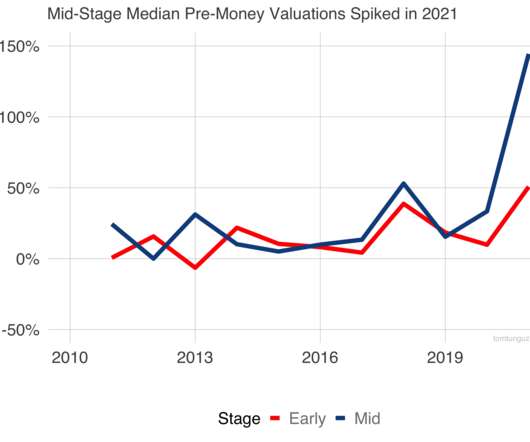

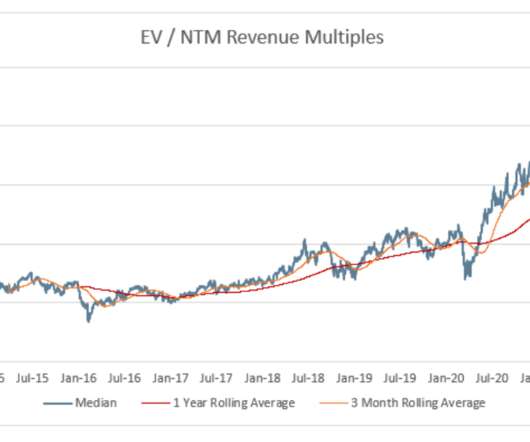

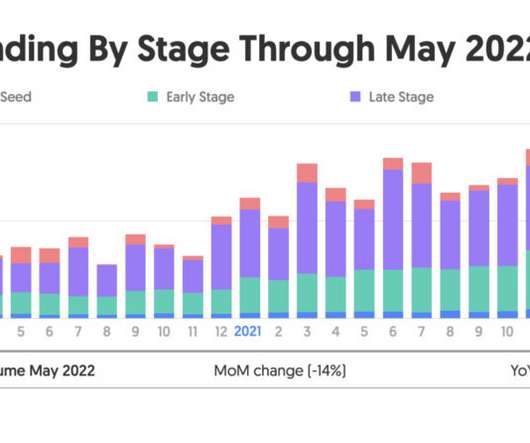

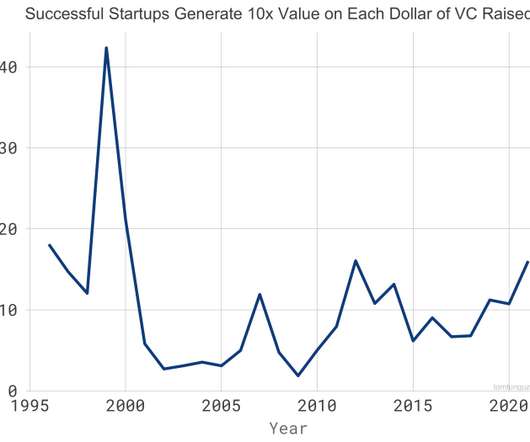

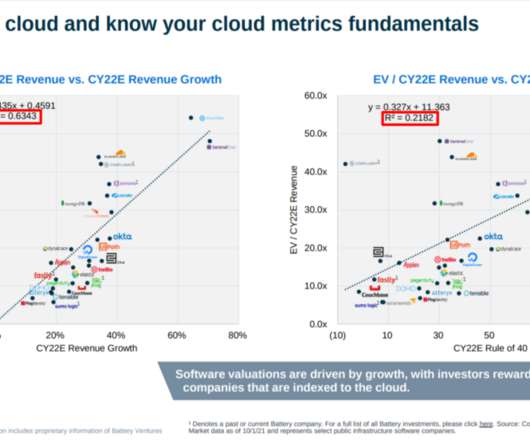

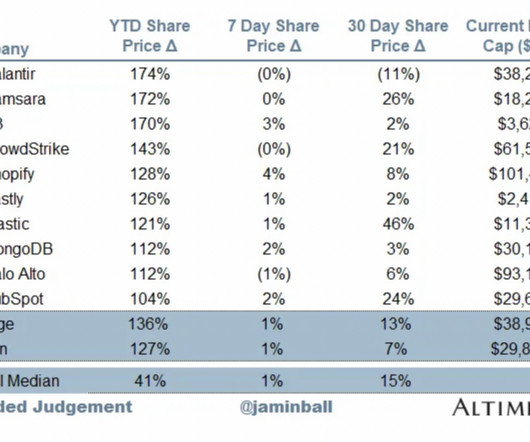

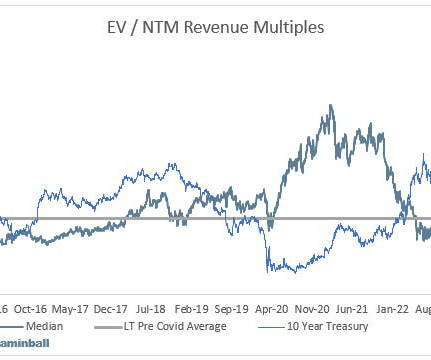

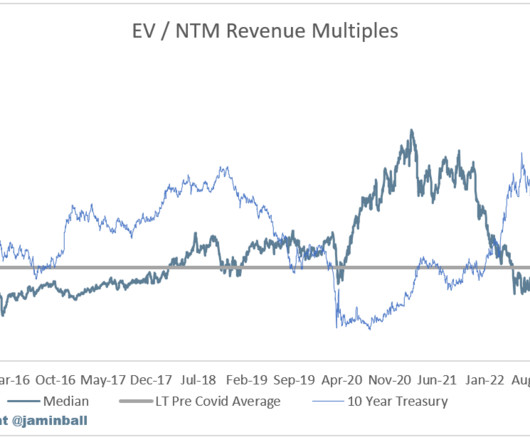

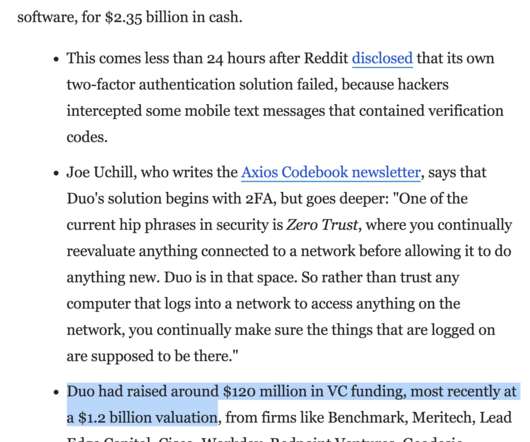

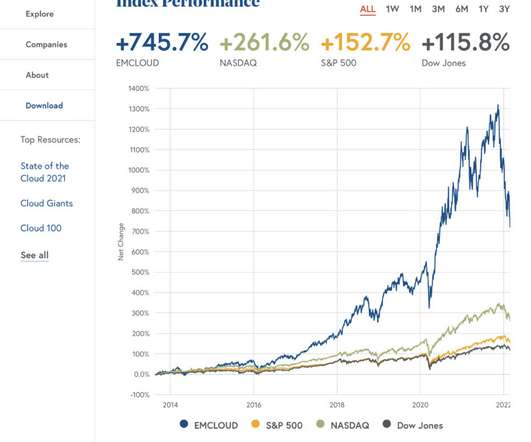

Subscribe now Shades of 2021 in Venture Markets Private markets are really starting to heat up, and I’m starting to see shades of 2021. ” I heard that a lot in 2021, and unfortunately not many call options hit… It’s hard to invest at 100x ARR and exit at 10x and make a return VCs aim for. .”

Let's personalize your content