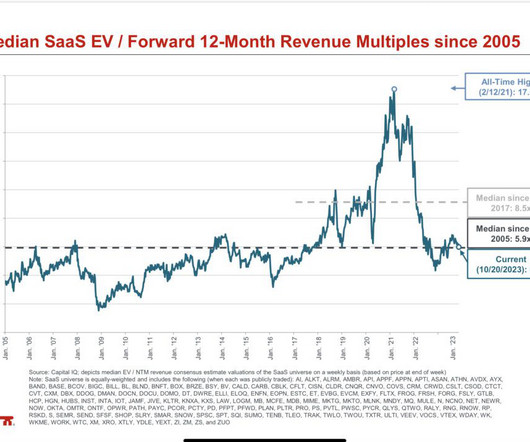

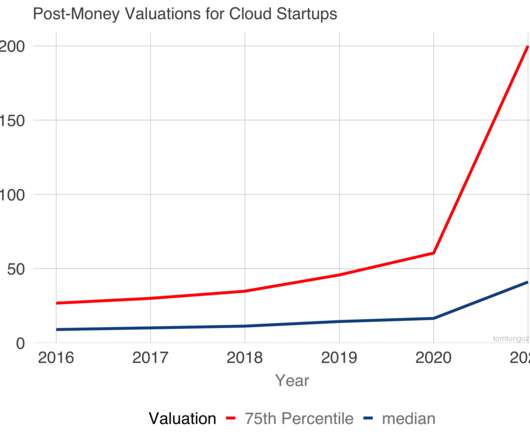

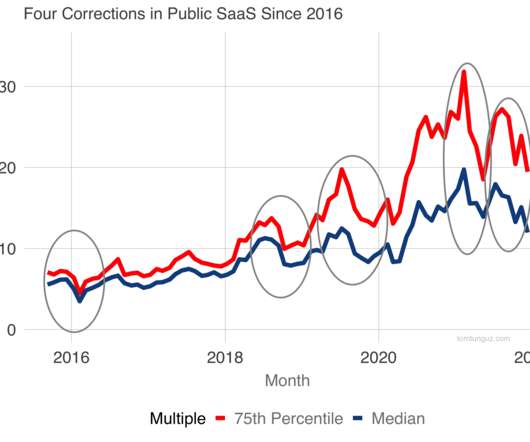

SaaS Multiples Are At a 3+ Year Low. Where It Goes From Here.

SaaStr

MAY 6, 2022

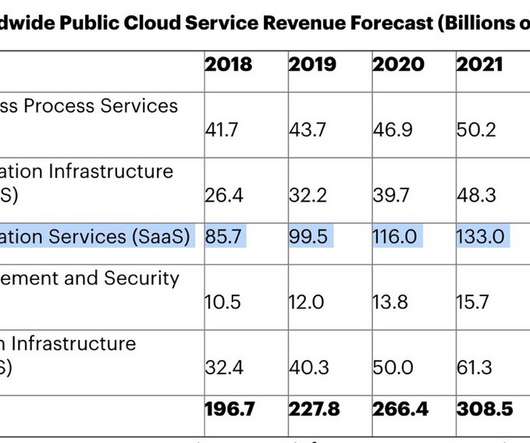

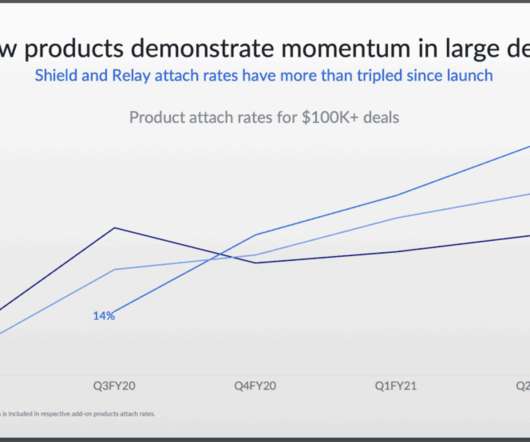

Many SaaS and Cloud leaders are down more than 50% from their all-time highs. But Covid did create a lot of artificial demand for Cloud products, especially the lockdown phase. Ultimately — revenue multiples. Update on cloud software multiples, charted alongside the 10Y and 5 year pre-covid NTM rev multiple average.

Let's personalize your content