Q: How many companies in the Fortune 500 raised venture capital? Why are so many people obsessed with venture capital when many successful businesses didn’t raise it?

There are many successful companies that did not raise venture capital, and VC does seem to get a bit too much media attention.

But … I looked at all the top Cloud 100 private SaaS/Cloud companies a little while ago.

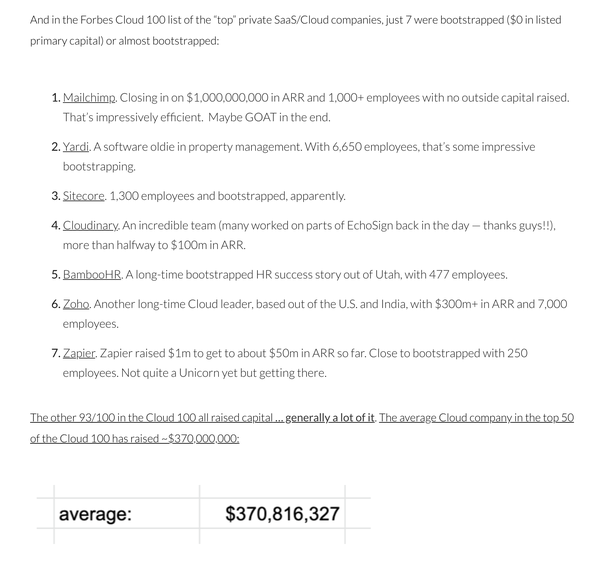

- How many got there without raising venture capital? Only 7. 7 out of 100. And really, 5 (2 did raise capital, just modest amounts).

- And the average Cloud unicorn in fact has raised a stunning $370,000,000 (!!). Of course, most of that is late-stage capital, and in many cases, in lieu of going IPO earlier. But that’s still a lot of venture capital taken in.

So, there are many ways to do it. Atlassian and Qualtrics and Mailchimp got huge with little or no venture capital, at least for a long time. You absolutely can get there without any venture capital if you budget in the time and especially, have high net revenue retention and at least some virality to keep growth up and cost of acquisition down.

But 95% of the Cloud unicorns and leaders got there with at least some VC capital. And generally, a lot of it.

More here: The Average SaaS Unicorn Raises $370,000,000. And Bootstrapping is Rare. | SaaStr