Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital?

SaaStr

JULY 5, 2023

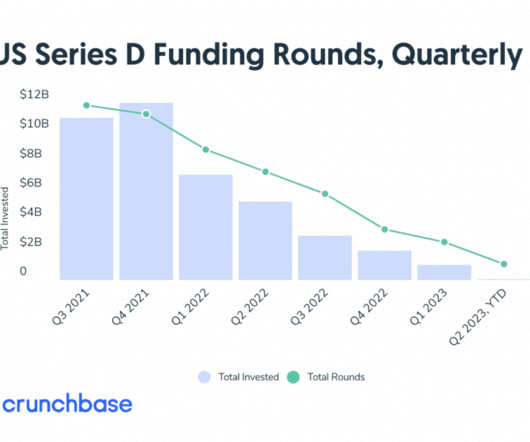

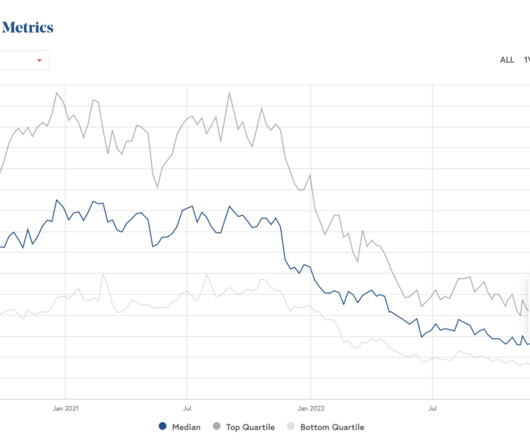

Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital? In SaaS, growth investments generally will all be at at least $20m ARR, or $40m ARR, or more. You’re often betting on a $10B+ IPO, and that’s just pretty darn rare these days in SaaS and Cloud.

Let's personalize your content