Average Customer Acquisition Cost: Benchmark by Industry and How to Improve It

User Pilot

AUGUST 10, 2023

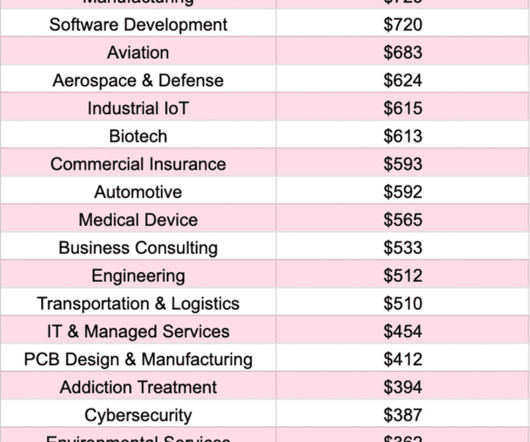

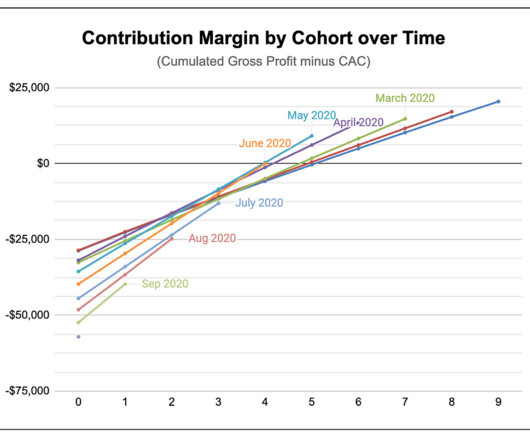

And the customer acquisition cost (CAC) shows you how effective you’re with your sales and marketing efforts to acquire new customers. In this article, we’ll delve into the ins and outs of CAC, its industry-specific benchmarks, and the proven practices to improve it. The average CAC varies across industries.

Let's personalize your content