Clouded Judgement 1.12.24 - Hard Truths

Clouded Judgement

JANUARY 12, 2024

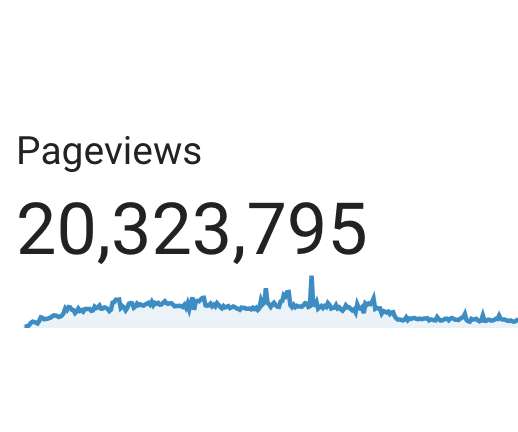

Every week I’ll provide updates on the latest trends in cloud software companies. Subscribe now Reinventing Founder Friendliness - Back to the Future This week I joined Ed Sim (Founder and Managing Partner at Boldstart Ventures) on Harry Stebbings podcast to chat about the state of venture backed companies heading into 2024 and 2025.

Let's personalize your content