Top SaaStr Content for the Week: Y Combinator, Mark Roberge, State of the Cloud 2022 and lots more!

SaaStr

OCTOBER 2, 2022

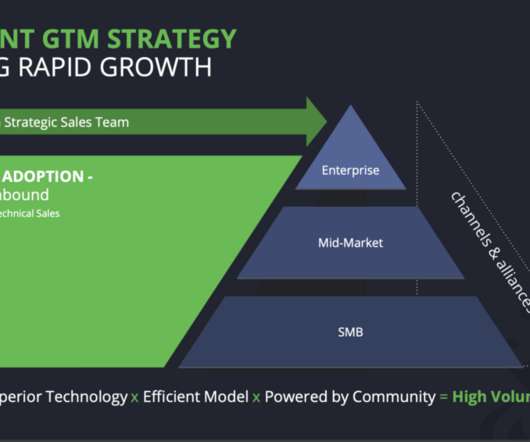

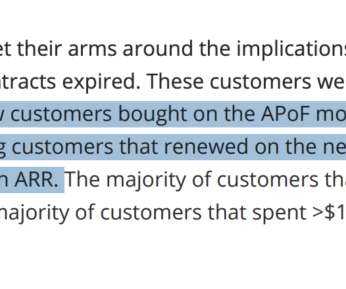

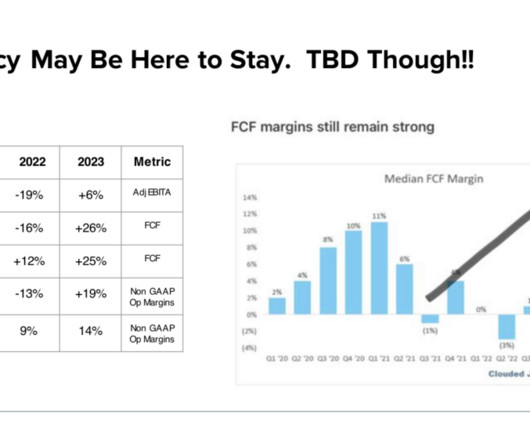

State of the Cloud 2022: The Centaur Report With Bessemer Venture Partners (Pod 593 + Video). The Challenge with SMB SaaS: High Growth Can Only Mask High Churn For Just So Long (Updated). The post Top SaaStr Content for the Week: Y Combinator, Mark Roberge, State of the Cloud 2022 and lots more! I Mean, It’s Crazy.

Let's personalize your content