Raise, Sell, Merge, or Scale? How to Navigate the Market Downturn.

SaaSOptics

AUGUST 11, 2022

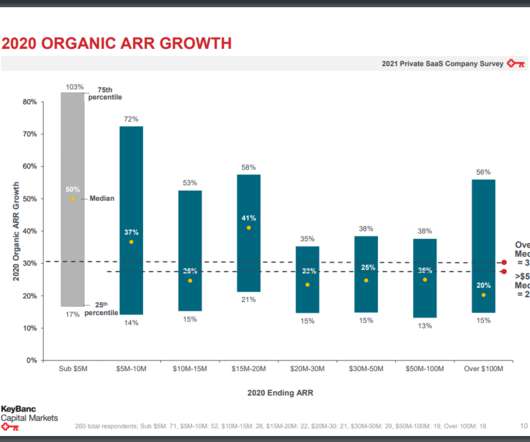

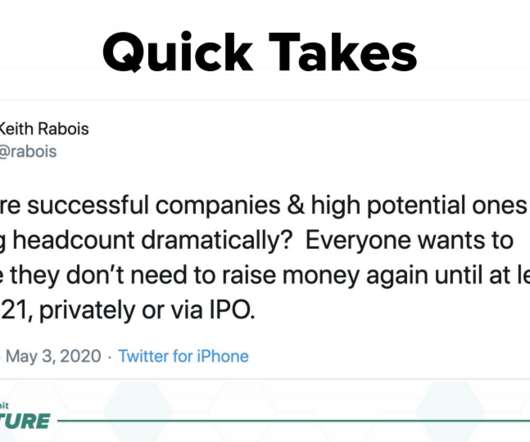

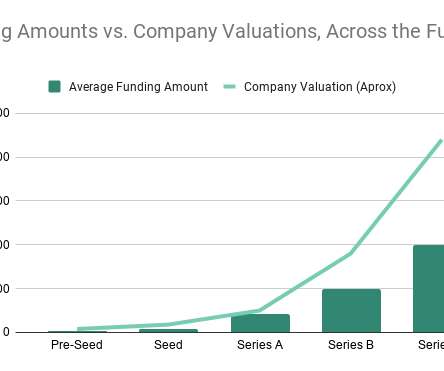

Raise, Sell, Merge, or Scale? In this article, we’ll help you determine the next best step for your business and provide guidance on whether you should raise, sell, merge, or scale your SaaS. Option 1: Raising capital. So what should you do if you’re strapped for cash and have your sights set on venture capital?

Let's personalize your content