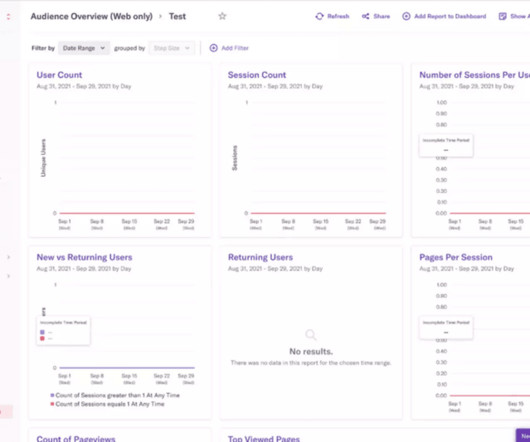

5 Interesting Learnings from Digital Ocean at $700,000,000 in ARR

SaaStr

DECEMBER 27, 2023

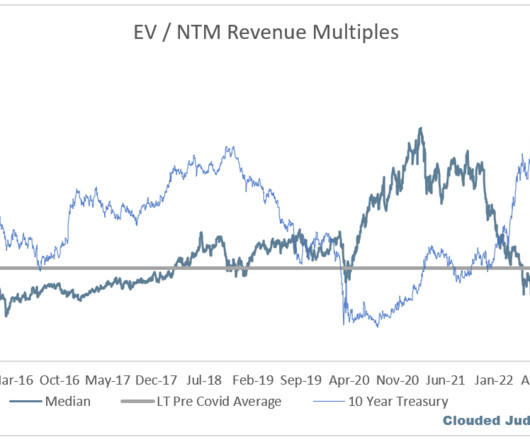

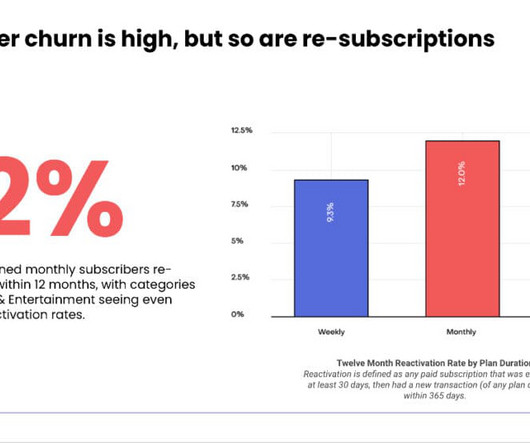

Many have used Digital Ocean at the cheaper, simpler version of AWS-Azure-Digital Ocean to get going fast and quickly. Digital Ocean is only growing 16% now at $700m ARR, and churn is up and NRR down. Churn Stable. Churn did grow from 12% to 15%, but NRR fell far faster, from 118% to 96% in just one year. Or at least.

Let's personalize your content