Clouded Judgement 2.2.24 - Cloud Giants Report Q4 '23

Clouded Judgement

FEBRUARY 2, 2024

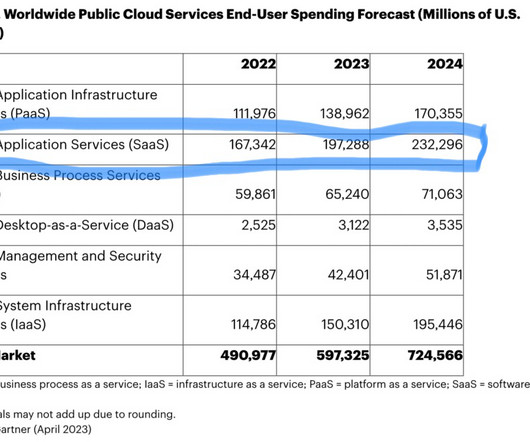

Every week I’ll provide updates on the latest trends in cloud software companies. Subscribe now Cloud Giants Report Q4 ‘23 Two quotes from the Amazon and Microsoft earnings call really stood out to me this week. Sometimes they’re classic cloud migrations. Follow along to stay up to date!

Let's personalize your content