A Funny Thing Happened on the Way to Sand Hill Road

Tom Tunguz

DECEMBER 13, 2022

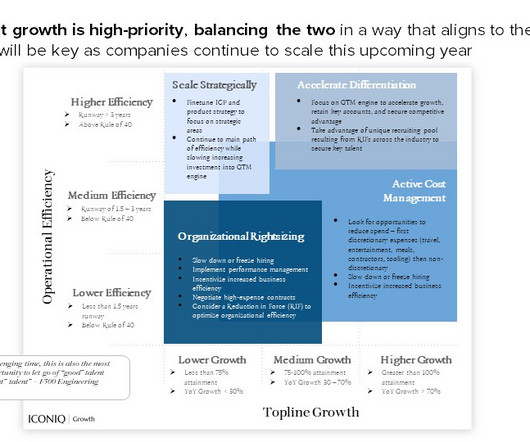

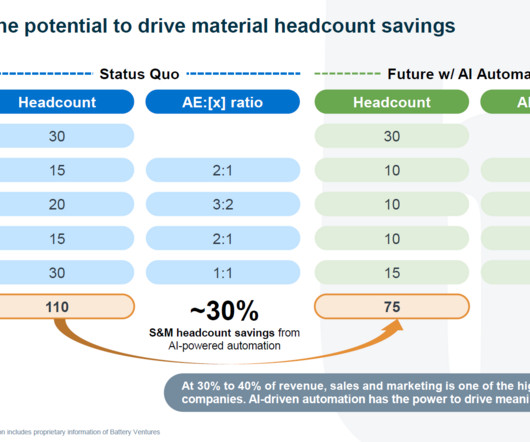

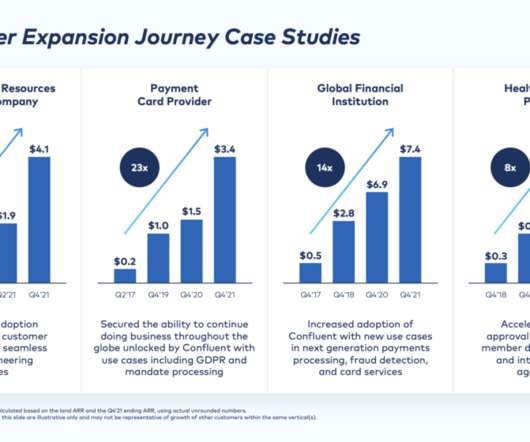

So, did headcount at the Series A. In 11 years, the median headcount at Series A swelled from 15 to 28. [1]. In 2021, employment costs per capital increased to roughly $200k. That’s a lot of buffer to achieve Series B metrics [1]. But we’re no longer in 2021. Round sizes ballooned. Let me explain : Era.

Let's personalize your content